Texas Life Insurance [2026]

There are 123 Texas insurance companies operating with their headquarters in TX, which means plenty of local companies to choose from. Learn more about Texas insurance quotes, companies, and policies here.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

We offer life insurance quotes from several of the best TX life insurance companies. We created this guide to help you search for a life insurance policy in Texas. With so many companies and policies to choose from, finding the right life insurance coverage to protect you and your family can be a tough task. Whether you have a spouse, dependent children, or other loved ones to provide financial protection for, you need a policy with adequate protection, affordable premiums, and you may be interested in some additional benefits that you can get out of some of the available insurance plans.

Our guide should reduce that difficulty and help you understand the differences in life insurance, including a few life insurance terms, and to find resources from reputable life insurance companies in your area, as well as leave you with some life insurance tips to help you compare plans.

Think of this article as life insurance customer service — learn everything you need to about finding affordable life insurance quotes by clicking on our FREE quote tool. Get started now.

What do you need to know about life insurance in Texas?

We offer Lone Star residents life insurance from several A-rated life insurance companies in the United States. Life insurance is very similar from state to state, with a few exceptions. This guide should help you understand the differences as well as find resources in your state.

Policy Cost — The premium (cost) you pay for your life insurance policy does not vary by state. It is the same regardless of which state you live in. Your premium will be set by life insurance companies after you’ve completed an application, then approved by the United States State Insurance Department.

Company Availability — Not all companies are available in every state. For example, if a life insurance company has not filed its product or rates with your State Insurance Department, that company won’t be available in your state. Company availability changes often due to new filings, as companies gain licenses as they expand into different communities.

Product Availability — There are instances where life insurance companies offer only specific products or riders (optional additional coverage) in a state. For example, a company may offer a child insurance rider or accelerated death benefit rider on their policy, but the feature may not be available in all states.

These exclusions can be viewed by the policyholder by clicking on the life insurance companies in the list below.

The state’s insurers also offer residents a 30-day grace period and a guaranteed death benefit up to $300,000.

How much are life insurance rates?

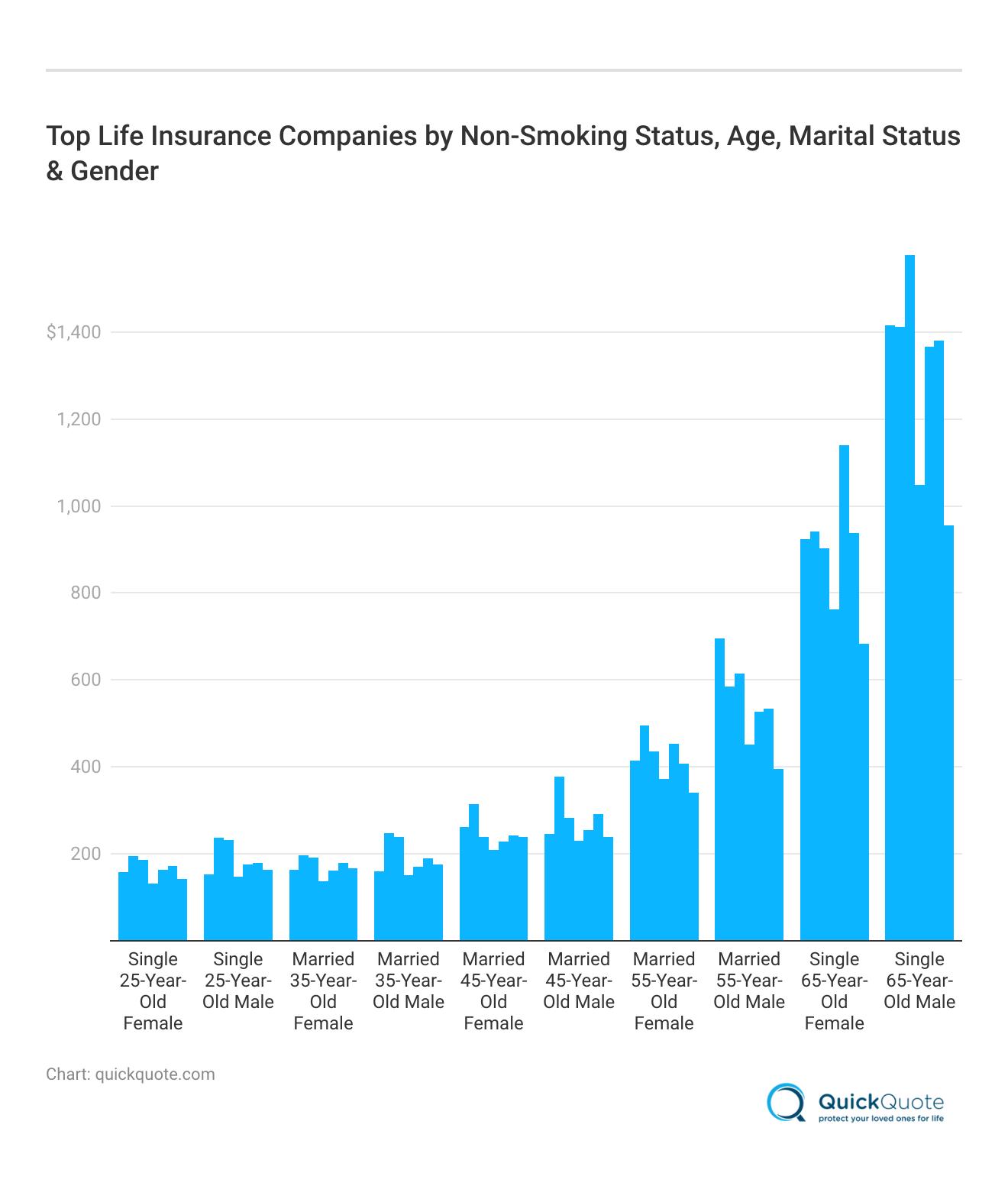

Let’s take a look at what the best life insurance companies charge. This will give you an idea of what to expect with life insurance rates. In the first chart below, you’ll notice the average annual rates for non-smokers based on age, marital status, and gender.

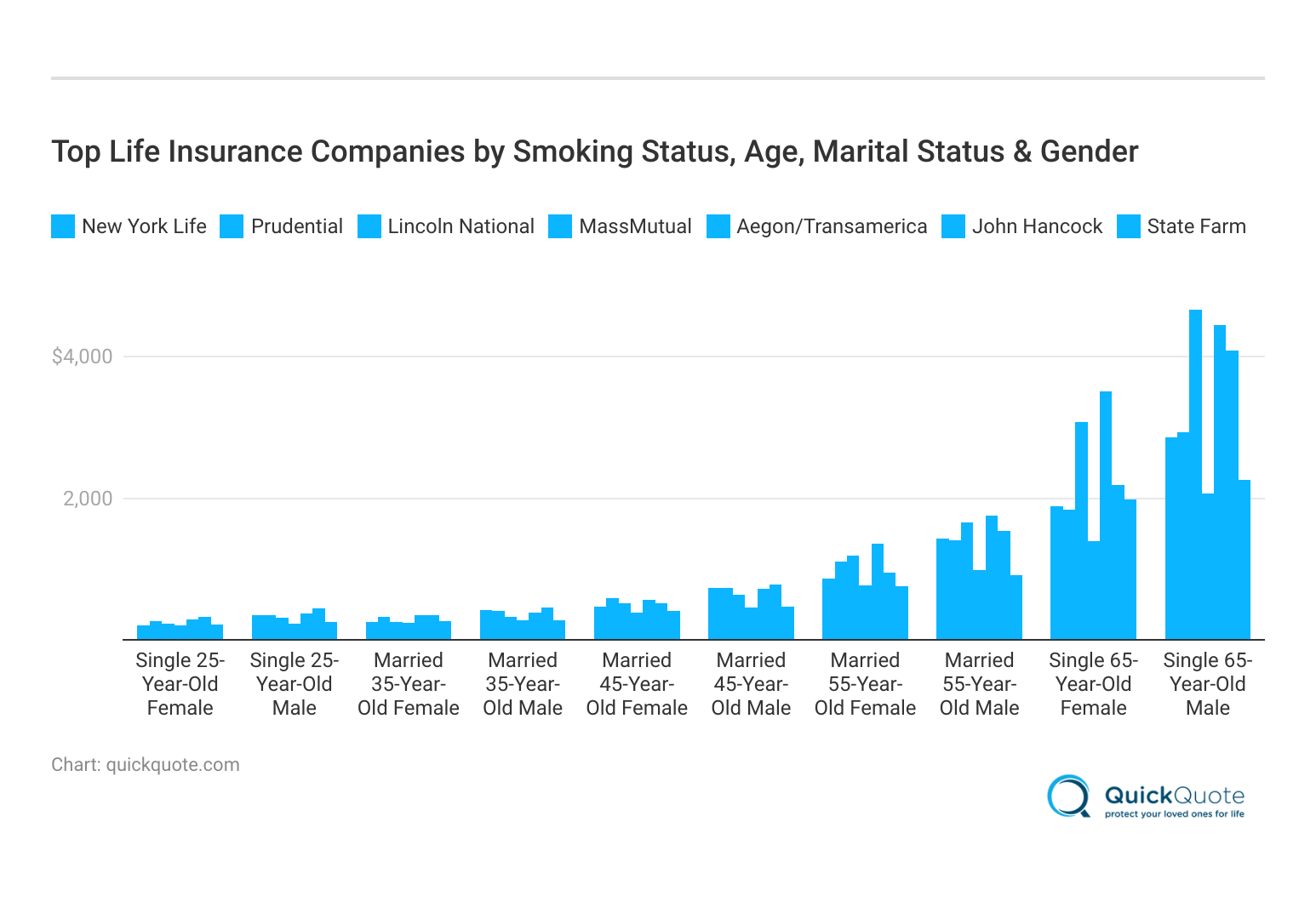

Now, take a look at the average annual rates for smokers based on age, marital status, and gender. As you can see, Texas life’s quotes are much higher, presumably because of the higher mortality risk.

You can also see how many life insurance companies there are in TX versus the other southern states.

According to the chart, there are 123 life insurance companies in the Lone Star State that specifically do business within the state, which means plenty of life insurance policy options for you.

Use our free quote tool on this page to find out exactly which life insurance companies will offer you the best life insurance rates.

Read more:

What is the Texas Guaranty Association?

State guaranty associations are committed to protecting resident policyholders and beneficiaries in the event of an insurance company’s insolvency, or bankruptcy. (For more information, read our “How To Get Life Insurance With a Bankruptcy Record“).

The association is made up of all insurance companies licensed to sell life insurance, health insurance, and annuities in the state.

If an insurance company becomes insolvent (goes out of business), the association steps in to protect policyholders by continuing coverage and paying claims up to defined limits.

In the state, a life insurance policy is protected up to $300,000. This amount is the maximum benefit provided for any one life. In other words, multiple policies on any one person are limited to this amount.

Where can more Texas life insurance information be found?

Below, we have provided a list of all the necessary state contacts for state residents with life insurance claims and other related matters.

It’s also important to check the financial strength ratings and customer service ratings for any insurer you’re interested in. That’s the best way to compare and see how these insurers stack up.

Guaranty Association

If you need information about a life insurance or health insurance company, contact the Texas Life & Health Insurance Guaranty Association at 1-512-476-2101 or visit the website under the same name.

Insurance Department

The Texas Department of Insurance (TDI) includes all of the general legal information you need to know about all forms of insurance in the state.

Specifically, you can learn more about the state fire marshal in detail, find out information on workers’ compensation, learn how to check your home and auto insurance policy rates, and more.

To contact the Texas Department of Insurance, you can call at 1-855-839-2427 or visit the website.

At QuickQuote, we offer detailed reviews on life insurance companies, including those operating in the state, and we update them regularly based on information from credible sources.

However, should you need more information, the TDI official website also includes information about life insurance companies, such as the TX Life Insurance Company and more.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What companies offer term life insurance?

Because researching insurance companies is overwhelming, we have compiled a list of reviews for term life insurance companies that meet all requirements and should make finding life insurance companies in Texas even easier.

Among this list is a review for North American Company for Life & Health Insurance, a life insurance company with affordable rates and plenty of life and health insurance policies to choose from.

The company also offers a variety of riders that you can add to your health or life insurance policy to customize it to best fit you and your beneficiary’s needs.

North American is only one of many great term life insurance companies that offer policies in the Lone Star state.

The best way to whittle down this list is to comparison shop, meaning take the top three companies for you and compare their rates and policies. This will give you an idea of which company will be able to provide the coverage you need at the price you want. Plus, your ideas of the best life insurance companies in Texas might differ from someone else, so it’s always a good idea to craft your own opinion.

What are the types of life insurance?

Term life insurance and whole (permanent) life insurance are the two general forms of insurance policies offered by life insurance companies.

Though there are many differences between the two, the main difference between term vs. permanent life insurance is that there is a set rate until death with whole (permanent) life insurance, while you pay for a specific term that expires before death with term life insurance.

As stated above, there are several insurance companies that sell term life insurance in the state. Among these companies are Lincoln Financial Group, Haven Life/MassMutual Life Insurance, John Hancock Life Insurance Company, and more.

Read more: MassMutual Life Insurance Review

Don’t wait to get started. If you’re ready to buy life insurance, use our free quote tool to get instant, affordable Texas life insurance quotes.

Frequently Asked Questions

What is insurance?

insurance is a contract between an individual (the policyholder) and an insurance company. It provides a lump sum payment, known as the death benefit, to the designated beneficiaries upon the policyholder’s death. It is designed to provide financial protection and support to the policyholder’s loved ones in the event of their passing.

Why is insurance important in Texas?

insurance is important in Texas, just like in any other state, because it helps ensure financial security for your loved ones after you’re gone. It can help cover funeral expenses, pay off debts, replace lost income, and provide for your family’s future needs.

What types of insurance are available in Texas?

In Texas, you can generally find two main types of insurance: term insurance and permanent insurance. Term insurance provides coverage for a specific period (term), while permanent insurance offers lifelong coverage with a cash value component.

How much insurance coverage do I need in Texas?

The amount of insurance coverage you need in Texas depends on several factors, such as your income, debts, dependents, and future financial goals. It’s important to assess your needs and consider factors like your family’s expenses, outstanding debts, education costs, and future financial obligations to determine an appropriate coverage amount.

Can I buy insurance in Texas if I have pre-existing health conditions?

Yes, it is possible to buy insurance in Texas even if you have pre-existing health conditions. However, the availability and cost of coverage may vary depending on the severity of your condition and the insurance company’s underwriting guidelines. It’s recommended to work with an insurance agent or broker who can help you find suitable options.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.