Washington Life Insurance [2026]

Washington insurance offers residents a timely payment on claims, usually within 30 days, and some insurance companies give a free look period. Compare quotes from multiple Washington insurance companies before buying a policy.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

UPDATED: Feb 27, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 27, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Washington life insurance is very similar to that of other states, with a few exceptions.

- Washington life insurance companies are required to offer a 10-day free look period.

- You can contact the Washington Guaranty Association or Washington State Office of the Insurance Commissioner if you have questions.

We offer Washington residents life insurance from several of the best Washington state life insurance companies. Life insurance is very similar from state-to-state, with a few exceptions, so your WA life insurance quotes may be steady.

However, this guide should help you understand the differences in Washington life insurance as well as find resources in your state. We’ll also show you how to get the best life insurance in Washington.

Before we dive into this guide, find affordable Washington life insurance rates by clicking on our FREE quote tool above. Get started now.

Where can I get Washington life insurance quotes?

We offer Washington residents life insurance from several A-rated life insurance companies. Life insurance is very similar from state to state, with a few exceptions. This guide should help you understand the differences as well as find resources in your state.

Policy Cost – The premium (cost) you pay for your life insurance policy does not vary by state. It is the same regardless of which state you live in. Premiums are set by life insurance companies then approved by the State Insurance Department.

However, a ZIP code must be provided when getting quotes and policies, because life insurance forms vary by state.

Company Availability – Not all companies are available in every state. For example, if a life insurance company has not filed its product or rates with your State Insurance Department, that company won’t be available in your state. Company availability changes often due to new filings.

Product Availability – There are instances where life insurance companies offer only specific products or riders in a state. For example, a company may offer a child insurance rider on their policy, but the feature may not be available in all states.

These exclusions can be viewed by clicking on the life insurance companies in the list below.

Life insurance companies in Washington are required to give a free look period. This means you have 10 days to review the policy and decide if it’s right for you.

If you give the policy back, the company must issue a refund within 30 days of the original policy purchase, or they owe you an extra 10 percent.

If, for some reason, you miss a payment on your premiums, the company must offer you 30 days to make the payment before cancelling the policy. Washington life insurance companies also offer residents a timely payment on claims, usually within 30 days.

How much are life insurance rates in Washington?

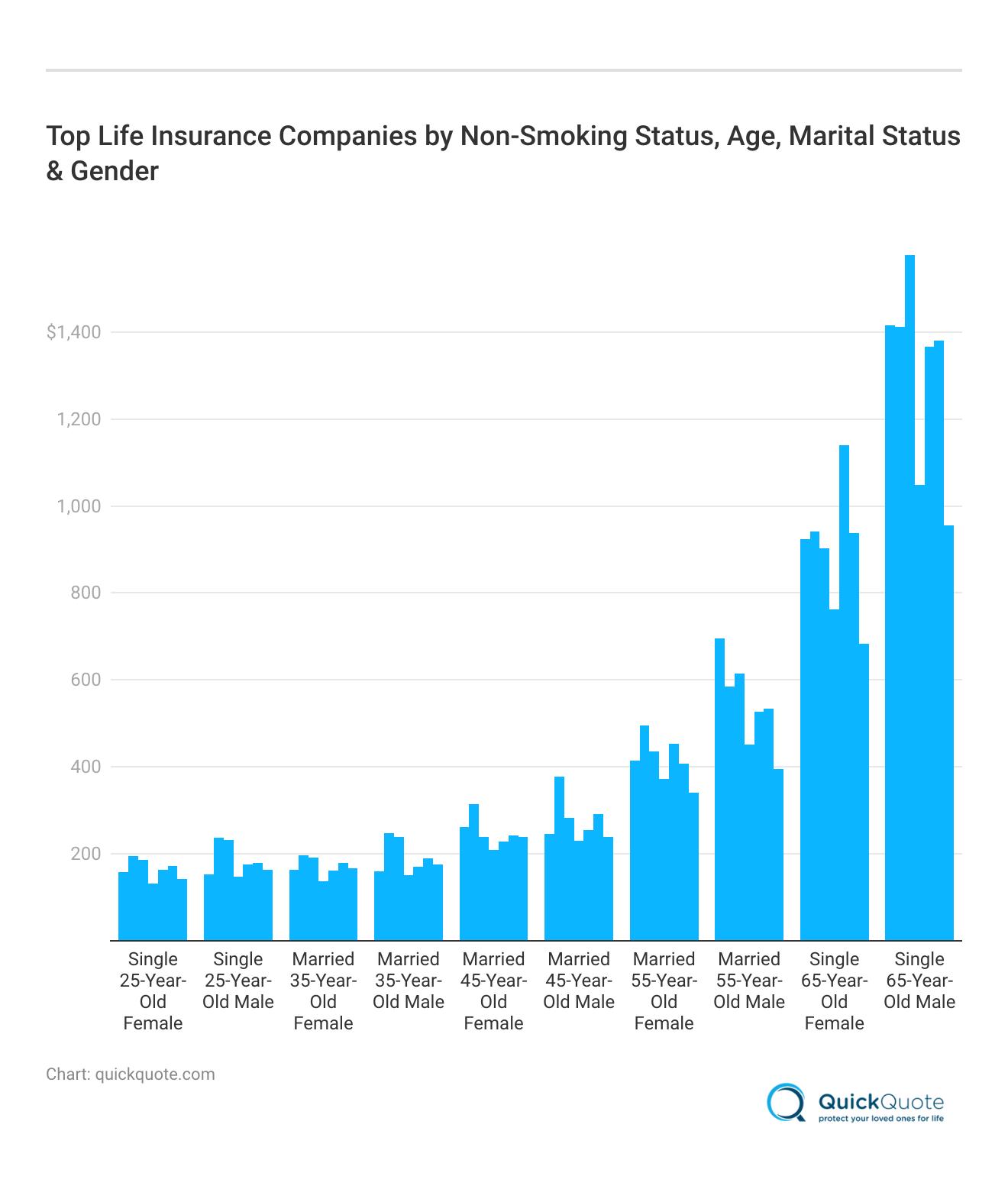

You may be wondering what to expect with Washington life insurance rates. In the chart below, you’ll find what the best life insurance companies charge based on age, marital status, and gender for non-smokers. However, it’s possible that your rates will be different, especially if you smoke.

You can also see how many life insurance companies there are in Washington versus the other western states.

According to the chart, there are six Washington life insurance companies that specifically do business within the state. So, chances are, those six companies will offer the best life insurance in Washington. That also means more Washington life insurance policy options for you.

When searching for life insurance (and even after you purchase a life insurance policy), you should schedule regular reviews of your rates. In between reviews, you should check your rates if:

- Your marital status changes

- Your family grows

- You or your spouse change employment (including starting or growing a business)

- You or your spouse acquire a disability

- You become the primary caretaker for a disabled or elderly family member

- Your household income changes

- A member of the family leaves for college

Check out our free quote tool on this page to find out exactly what your WA life insurance quotes will be.

What is the Washington Guaranty Association?

What happens if my life insurance company goes bankrupt?

State guaranty associations are committed to protecting resident policyholders and beneficiaries in the event of an insurance company insolvency. The association is made up of all Washington state life insurance companies that sell life insurance, health insurance, and annuities in the state. (For more information, read our “How to Sell Your Life Insurance Policy“).

If an insurance company becomes insolvent (goes out of business), the association steps in to protect policyholders by continuing coverage and paying claims, up to defined limits.

In Washington, a life insurance policy is protected up to $500,000. This amount is the maximum benefit provided for any one life. In other words, multiple policies on any one person are limited to this amount.

Who can I contact to learn more about Washington life insurance?

Here is a list of all the necessary state contacts for residents with Washington life insurance claims and other related matters.

Guaranty Association

If you need information about Washington life insurance or Washington disability insurance, contact the Washington Life & Disability Insurance Guaranty Association at 1-360-426-6744 or visit the website.

Insurance Department

If you need to contact the Washington Department of Insurance or life insurance commissioner for questions about your Washington state life insurance beneficiary or to file a Washington State Department of Insurance complaint, you can reach the Washington State Office of the Insurance Commissioner at 1-800-562-6900 or visit the website.

Also known as the Washington Insurance Bureau and the Washington OIC Insurance, here you can also obtain information regarding your Washington state employee life insurance.

Legal Info

QuickQuote is licensed to sell life insurance in Washington under Agency License Number 143566.

The licensed company principal is Tim Bain, Agent License Number 177518.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What life insurance companies are in Washington?

Below is a list of life insurance companies in Washington state:

- American General Life Insurance Company

- Banner Life Insurance Company

- Fidelity Life Association

- Haven Life / MassMutual

- John Hancock Life Insurance Company

- Lincoln National Life Insurance Company

- Metlife Life Insurance Company

- North American Company for Life & Health Insurance

- Pacific Life & Annuity Company

- Principal Life Insurance Company

- Protective Life Insurance Company

- Pruco Life Insurance Company (Prudential)

- Sagicor Life Insurance Company

- The Savings Bank Life Insurance Company of Massachusetts (SBLI)

- Transamerica Life Insurance Company

- United of Omaha Life Insurance Company

As you can see, you have a lot of options. Make sure to compare life insurance quotes from multiple companies.

Frequently Asked Questions

What types of insurance are available in Washington?

Residents of Washington have access to various types of insurance, including term insurance, whole insurance, universal insurance, and variable insurance. Each type offers different features, benefits, and premiums, allowing individuals to choose the coverage that aligns with their needs and financial goals.

Are there any specific regulations or requirements for insurance in Washington?

Washington, like other states, has regulations and requirements that govern the sale and operation of insurance. Insurance companies operating in Washington must comply with the state’s insurance laws and regulations. Additionally, applicants for insurance may be subject to underwriting guidelines, which include factors such as age, health, and lifestyle habits.

Can residents of Washington purchase insurance from any insurance company?

Washington residents can purchase insurance from insurance companies that are licensed to operate in the state. It is advisable to research and compare different insurance providers to find a reputable company that offers suitable coverage options and competitive premiums.

How do I determine the appropriate amount of insurance coverage for my needs?

Determining the appropriate amount of insurance coverage depends on several factors, including your financial obligations, income replacement needs, outstanding debts, and future expenses such as education costs or mortgage payments. It is recommended to assess your financial situation and consult with a licensed insurance professional who can help evaluate your coverage needs.

Can I change my insurance policy in Washington if my circumstances change?

Yes, insurance policies can typically be changed or updated to reflect changes in circumstances. You may have the option to increase or decrease coverage, add riders or endorsements, or modify the policy’s terms. It is advisable to review your policy contract and contact your insurance provider to discuss any desired changes or updates.

Are insurance proceeds taxable in Washington?

In general, insurance proceeds are not subject to income tax in Washington or at the federal level. The death benefit paid out to beneficiaries is typically considered tax-free. However, it is important to consult with a tax professional for guidance specific to your individual circumstances.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.