Life Insurance for Foreign Nationals [2026]

Just because you're a foreign citizen doesn't mean you can't buy U.S. life insurance for foreign nationals. In fact, most non-citizens living or doing business in the U.S. qualify for term life insurance for foreign nationals starting as low as $12.70/month. Use our free tool below to start comparing life insurance quotes for free.

Read moreReady to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

In addition to celebrating the financial peace of mind it gives to families, as a foreign national, learning about life insurance can also be a valuable financial tool. Life insurance for foreign nationals can be an integral part of an overall investment strategy, retirement solution, or estate plan.

According to estimates from the Department of Homeland Security, there are currently 2.3 million foreign nationals living in the country. Can a non-US citizen buy life insurance? The short answer is: yes.

Most people living or doing business in the United States have access to the same life insurance coverage as citizens.

This guide is designed to give a complete overview of U.S. life insurance for foreign nationals, including special considerations to keep in mind, sample rates, and tips on how to find the best policies and providers.

Start comparing life insurance for foreign nationals now by using our FREE quote tool above.

Top Life Insurance Companies for Foreign Nationals

There are nearly 1,000 life insurance companies in the United States. A majority of them sell policies to non-citizens. If you’re one of those 2.3 million foreign nationals and are looking for life insurance coverage, one of the simplest ways to find it is by starting with the top-ranking insurers in the country.

The following table shows the current top 20 overall providers of life insurance, which make them some of the best life insurance companies for foreign nationals.

Top 10 Life Insurance Companies by Market Share & Protective Life Market Share

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $10,877,337,000 | 6.7% |

| 2 | Northwestern Mutual | $10,550,806,000 | 6.5% |

| 3 | New York Life | $9,385,843,000 | 5.8% |

| 4 | Prudential | $9,170,883,000 | 5.6% |

| 5 | Lincoln National | $8,825,314,000 | 5.4% |

| 6 | MassMutual | $6,874,972,000 | 4.2% |

| 7 | Transamerica | $4,867,311,000 | 3.0% |

| 8 | John Hancock | $4,657,312,000 | 2.9% |

| 9 | State Farm | $4,636,147,000 | 2.9% |

| 10 | Securian | $4,426,864,000 | 2.7% |

| 20 | DAI-ICHI Life Holdings Inc Grp (Protective Life) | $2,450,639,110 | 1.41% |

Many of these top providers are international companies with businesses and customers all over the world. They are likely to sell a life insurance policy for foreign nationals among their product offerings.

Sample Life Insurance Rates

To give you an idea of how much life insurance coverage might cost you, here is a look at the sample premiums for a non-smoker from those top companies.

20-Year Term Life

Average Monthly 20-Year Term Life Insurance Rates by Age and Gender

| Policyholder Age | $100,000: Male Average Term Life Monthly Rates | $100,000: Female Average Term Life Monthly Rates | $250,000: Male Average Term Life Monthly Rates | $250,000: Female Average Term Life Monthly Rates | $500,000: Male Average Term Life Monthly Rates | $500,000: Female Average Term Life Monthly Rates |

|---|---|---|---|---|---|---|

| 25 | $14.53 | $12.70 | $23.27 | $18.72 | $34.79 | $27.39 |

| 30 | $14.96 | $13.22 | $24.59 | $20.44 | $37.39 | $29.59 |

| 35 | $17.57 | $15.40 | $26.09 | $22.19 | $40.04 | $32.19 |

| 40 | $21.40 | $18.62 | $33.72 | $28.49 | $54.79 | $45.69 |

| 45 | $26.54 | $22.97 | $45.47 | $37.42 | $79.19 | $66.14 |

| 50 | $36.02 | $29.32 | $69.59 | $54.59 | $126.14 | $96.99 |

| 55 | $50.98 | $38.11 | $105.72 | $78.97 | $203.14 | $143.99 |

| 60 | $84.91 | $60.20 | $183.79 | $131.17 | $355.39 | $248.84 |

| 65 | $144.51 | $97.44 | $323.42 | $220.99 | $625.09 | $432.84 |

Whole Life

Whole Life Insurance Monthly Rates by Age, Gender, & Coverage Amount

| Age & Gender | $100,000 Policy | $250,000 Policy | $500,000 Policy | $1,000,000 Policy |

|---|---|---|---|---|

| 25-Year-Old Male | $94 | $85 | $225 | $203 |

| 25-Year-Old Female | $108 | $97 | $260 | $234 |

| 35-Year-Old Male | $128 | $113 | $311 | $273 |

| 35-Year-Old Female | $154 | $132 | $376 | $321 |

| 45-Year-Old Male | $191 | $156 | $468 | $381 |

| 45-Year-Old Female | $235 | $192 | $578 | $470 |

| 55-Year-Old Male | $295 | $243 | $728 | $599 |

| 55-Year-Old Female | $399 | $312 | $989 | $770 |

| 65-Year-Old Male | $528 | $422 | $1,311 | $1,045 |

| 65-Year-Old Female | $712 | $568 | $1,525 | $1,215 |

If you’re a foreign national, there are additional factors that life insurers use to determine your rates that could result in costs significantly higher than these sample quotes, as we will discuss shortly.

Can a foreign national buy life insurance in the United States?

Many companies will sell life insurance policies to foreign nationals if they have financial obligations in the United States. Generally, they must meet one of the following criteria:

- Live in the U.S. (permanent resident, citizen, or hold a valid visa)

- Work in the U.S. (permanent resident, citizen, or hold a valid visa)

- Own real estate in the U.S.

- Own a business in the U.S.

- Have money in a U.S. bank account

- Married to a U.S. citizen

Another related question always asked is: Can a foreigner be a beneficiary? Yes. If you are a citizen and your spouse is a foreign national, you can still name them as your beneficiary.

Read more:

Life Insurance for Foreign Nationals: Special Considerations

There are some additional guidelines foreign nationals will need to keep in mind as they shop for a life insurance policy.

Application

If you’re a non-citizen buying a domestic life insurance policy, you must be in the United States for the entirety of the process. That includes the initial application, medical exam, and final paperwork. You can’t purchase remotely or through an intermediary.

You’ll also need to provide more documents than you would if you were a naturalized citizen.

One of the main questions asked is: do you need a social security number to get life insurance?

The answer is yes. If you have an ITIN number, valid visa, or green card, you can get a life insurance policy. You’ll be asked to provide that information with the application.

Typically, you’ll be asked to provide:

- Passport, I-94, W-9, and visa (if applicable)

- Copies of financial documents such as U.S. bank statements, property deeds, and investment account statements

- Medical records from your country of birth or residence (translated into English)

If you’re purchasing a survivorship policy, you’ll also need to provide the same documents for your spouse.

Policy Value

Some insurers require foreign nationals to purchase a minimum of $250,000 in coverage. Policies higher than $1 million will likely require additional financial information.

For applicants looking to buy high-value policies, some insurers will require proof of at least $1 million in global net worth.

Payments

All premium payments must be made with U.S. currency from a U.S. bank account.

Taxes

In the United States, life insurance benefits are non-taxable when they are paid directly to a beneficiary such as a spouse or a child. However, your country of origin (or residence if not currently living in the United States) could impose a tax.

Laws vary from country to country, so be sure to research yours and plan accordingly.

Foreign Residence & Travel Underwriting Guidelines

In addition to the usual risk factors that insurers use to make their decisions, insurers also approve applications and set rates based on your country of residence.

Typically, each country is assigned one of the following risk classification codes:

- A – Best

- B – Better

- C – Standard

- D – Deny

The following table provides a sampling of country classifications from a top 10 life insurance company.

Life Insurance Underwriting Country Codes

| Country | Code |

|---|---|

| Afghanistan | D |

| Australia | A |

| Belgium | A |

| Brazil | B |

| Canada | A |

| Cuba | C |

| Denmark | A |

| Dominican Republic | B |

| Egypt | C |

| El Salvador | C |

| Finland | A |

| France | A |

| Germany | A |

| Guatemala | C |

| Haiti | D |

| Hungary | A |

| India | C |

| Iran | D |

| Italy | A |

| Japan | A |

| Mexico | B |

| Netherlands | A |

| Pakistan | D |

| Poland | A |

| Russia | B |

| South Africa | B |

| Spain | A |

| Sweden | A |

| Turkey | B |

| Ukraine | B |

| United Kingdom | A |

| Venezuela | D |

| Vietnam | B |

Keep in mind that this list is not exhaustive and classifications can vary between companies. However, you can still use it to get an idea of how different countries rank on the scale and whether you’d be approved.

Life insurance for foreign nationals in Canada? Sure thing.

Life insurance for foreign nationals in South Africa? Yes.

Life insurance for foreign nationals in India? Probably.

Life insurance for foreign nationals in Venezuela? Maybe not.

Naming a Foreign National as a Life Insurance Beneficiary

A policy owner can designate a foreign national as the beneficiary of a life insurance policy and they will receive the proceeds tax-free.

However, if the foreign beneficiary is a spouse, the estate won’t be entitled to the unlimited estate tax marital deduction available to U.S. spouses.

If you’re transferring significant assets such as real estate, you might want to establish a Qualified Domestic Trust to receive the property. The trustee must be a U.S. citizen or a U.S. corporation such as a bank or trust company.

If you choose not to utilize a trust, it’s important to make sure the face value of the life insurance policy includes enough to pay the tax and preserve the overall value of the estate.

Read more:

The main drawback of naming a foreign national as a beneficiary is that it may slow down the claims process. If the beneficiary is not located in the United States, it could take longer to mail the claims packet and supporting documents back and forth.

It’s always important to check periodically to make sure your beneficiary’s address and contact information are up-to-date, but it becomes even more so when your beneficiary is a foreign national living out of the country.

How does life insurance for foreign nationals work?

A life insurance policy is a contract between you and the insurer. In exchange for a regular fee, the insurance company promises to pay a guaranteed lump-sum payment to your beneficiary upon your death.

As you shop for a life insurance policy, you’re likely to come across some industry terms you’ve never seen. Here is a quick glossary of the most common to help you better understand the process:

Common Life Insurance Terms and Definitions

| Term | Definition |

|---|---|

| Agent | An authorized insurance representative who sells and services policies |

| Beneficiary | The person designated by the policyholder to receive the proceeds from a life insurance policy |

| Death Benefit | A tax-free lump sum of money paid to the beneficiary upon the death of the insured |

| Face Amount | The amount of coverage provided by a life insurance policy |

| Final Expenses | Expenses incurred at the time of a person's death such as funeral costs, current liabilities, and taxes |

| Policy | The legal document stating the terms of the life insurance contract |

| Policyholder | The owner of the policy, typically the insured |

| Premium | The money paid to the insurance company in exchange for coverage |

| Risk Classification | The process which determines the risk associated with an applicant, which decides how much the insured’s premiums differ from the standard |

| Underwriter | The person who reviews the life insurance application, assigns a risk classification, decides if the applicant is acceptable, and determines the premium rate |

All life insurance policies fall into one of two general categories, term or whole.

term life insurance provides temporary coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you opt to renew it.

Watch the below video for a brief overview of term life insurance.

Permanent life insurance (aka Whole Life) provides permanent coverage for as long as you live.

For example, when considering the best life insurance for a 30-year-old man who buys a $250,000, 20-year term policy, that coverage ends at age 50. If he dies any time before 50, the insurer pays his beneficiary $250,000. If he dies any time after, the insurer doesn’t pay anything.

If the same man purchased a 0,000 whole life insurance policy, the coverage would never end. As long as his payments were current at his time of death, the insurer would pay his beneficiary $250,000, regardless of his age.

Watch the below video for a brief overview of whole life insurance.

Whole insurance is a more expensive option. With a term policy, there’s a chance the insurer won’t have to pay a benefit, which means they’ll make 100 percent profit off of the premiums paid. With a whole policy, they’ll make less profit since the payout is guaranteed.

They make up the difference by charging higher rates for whole policies.

Whole policies also come with a built-in savings component.

A portion of your premiums is placed in an interest-bearing account that either grows according to a fixed rate set by the insurer or according to the stock market similar to an IRA or 401(k).

The money earned from the savings account is either added to the death benefit or used to pay the premiums. It’s important to weigh the benefits and costs when choosing between term or whole life insurance.

Once you’ve decided on a policy, the basic life insurance process consists of the following steps:

- The customer fills out a life insurance application and a medical questionnaire.

- The insurer sends the application to an underwriter.

- The underwriter reviews the application to determine the risk of insuring the customer.

- The underwriter may request the customer complete a full medical exam.

- The underwriter either approves or denies the application.

- If approved, the underwriter assigns a risk classification, which determines the premium rate.

- The policy goes into effect and the customer begins making regular premium payments.

- If the premiums are current when the customer dies, the life insurer pays out the guaranteed face value of the policy.

Again, foreign nationals must be in the United States for the entirety of this process.

How much life insurance coverage do you need?

In addition to determining a policy type, you’ll also need to calculate your desired coverage. The process for determining how much coverage you need is different depending on whether you choose a term or whole policy.

For a whole policy, you only need to calculate a face value amount that will cover all of the financial goals outlined earlier.

For a term policy, you need to decide both face value and a term length.

Face Value

As discussed earlier, a life insurance policy needs to cover two types of obligations: immediate and future. The most common among those are income replacement for a spouse, tuition savings for a child, mortgage balances, and miscellaneous debts. (For more information, read our “Is Tuition Insurance Worth It?“).

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need, but there are simple formulas you can use to give yourself a general idea.

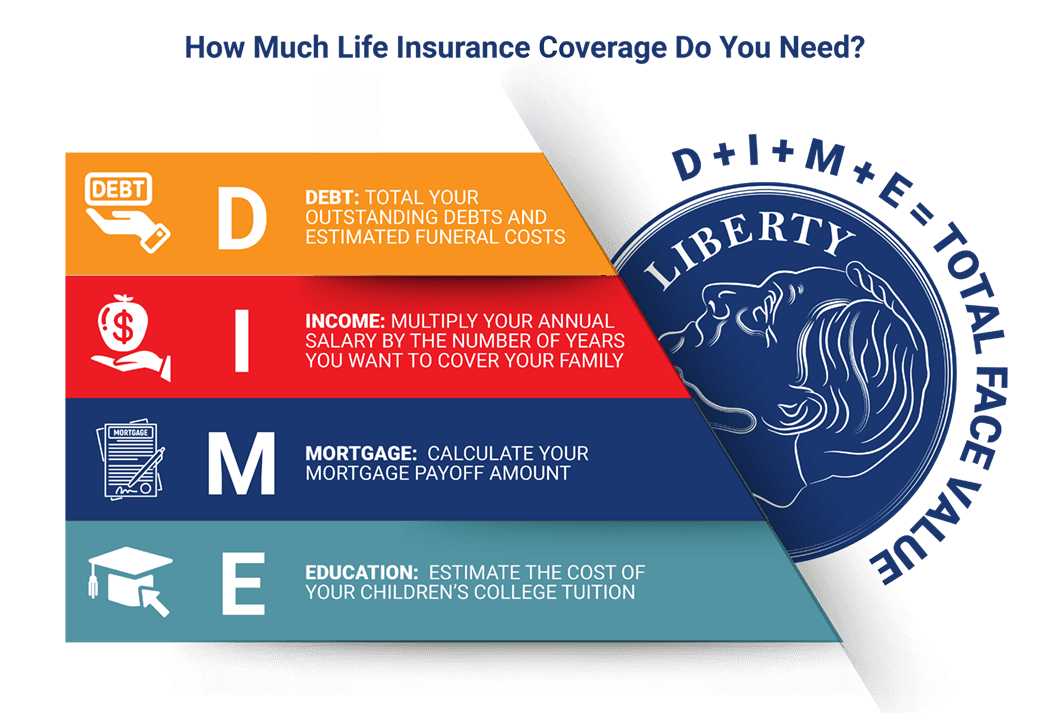

One popular method used by many online life insurance calculators is the DIME method. DIME is an acronym which stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you the minimum face value you need.

Here’s a quick example using the method.

A husband and father of two is shopping for life insurance. He and his wife both work full time. His annual salary is $75,000. The family has a remaining mortgage balance of $100,000, $10,000 left on a car loan, and $5,000 in credit card debt.

He plans to leave his wife 10 years’ worth of his salary and $30,000 for each child to cover the average cost of four years of in-state tuition at a public university.

After factoring in an average funeral cost of around $7,500, the man’s insurance needs are as follows:

- Debt – $10,000 car loan + $5,000 credit card + $7,500 funeral costs = $22,500

- Income – $750,000

- Mortgage – $100,000

- Education – $60,000

- Total need – $932,000

To meet all of those obligations, he should probably buy a life insurance policy with a face value of $1 million.

If you’re also using your life insurance policy as part of an estate plan, you’ll also need to factor in those additional expenses when choosing a face value.

Keep in mind that foreign nationals may have limitations imposed on them by the insurer.

For example, you might only need $100,000 in coverage, but an insurer might not sell policies lower than $250,000 to foreign nationals. Likewise, some limit coverage to a maximum of $5 million.

Policy Length

If you purchase a whole policy, you don’t need to decide on a term length since you have lifelong coverage, which is the case with most foreign nationals.

However, if you’re one of the few foreign nationals purchasing a term policy, you’ll need to choose a term length that covers all of your obligations. For example, if you have 20 years left on a 30-year mortgage, you should choose a 20-year term at the very least.

Here are the most important things to consider when choosing a term length:

- Number of years your spouse will depend on your income (years to retirement)

- Number of years dependent children will be living with you

- Number of years until co-signed or shared debts (such as a mortgage) are paid in full

- Number of years until your assets or savings grow enough to cover your future obligations

Ideally, you’d choose a term that extends until you reach your furthest milestone. After you clear those obligations, you’ll have much less need for insurance coverage.

Types of Term Life Insurance for Foreign Nationals

All term life insurance for foreign nationals follows the basic model of providing coverage for a limited amount of time. Within that general category, there are several variations:

- Level term

- Increasing term

- Decreasing term

- Renewable term

- Convertible term

- Return of premium

Each differs as follows.

Level Term Life Insurance

A level term policy is the simplest form of term insurance. The premiums never increase, and the amount of the death benefit remains the same throughout the entire term.

Term policies are typically sold in terms of 10–30 years, in five-year increments.

Increasing Term Life Insurance

For an increasing term policy, the death benefit increases each year you have the policy within a certain limit, usually between 2–10 percent. As the death benefit goes up, so will your premium.

For example, a $100,000 increasing term policy might increase by 5 percent every year. So in year two, the death benefit would be $105,000. In year two, it would be $110,250, and so on.

This type of policy might not be the best option for those who want long-term coverage.

For example, the death benefit will grow substantially during a 30-year policy. The premiums will also increase proportionally with the benefit.

At some point, those higher premiums will reduce the overall value of the policy. The premiums could even increase at a higher rate once the benefit crosses a certain dollar amount.

Decreasing Term Life Insurance

Decreasing term insurance is sometimes called mortgage protection insurance. The benefit decreases every year of the term.

The idea here is that you will be paying down the balance on whatever debt you intend the insurance to cover. As the balance decreases, so does the amount of coverage you need.

The premiums don’t decrease with the benefit. Instead, decreasing policies offer a much lower premium from the start that you pay continually throughout the term.

Renewable term policies allow you to extend or renew your policy for an additional term after the expiration date with no new medical exam.

Some renewable policies automatically renew every year up to a specific age (typically 65). Policies that renew annually usually see premiums increase each year as well.

Others automatically renew for your original length once your policy term ends.

Convertible Term Life Insurance

A convertible term policy allows you to convert your term policy into a permanent policy with the same face value, usually without taking a new medical exam.

Converting from term to whole insurance will increase your premiums. Some insurers also place age limits on conversions. Typically, you must convert before age 65.

Which Foreign Nationals Should Buy Term Life Insurance

Term coverage is the simplest and cheapest form of life insurance. Still, term policies are among the least used by foreign nationals.

In fact, some life insurers don’t even offer term policies to non-citizens at all. Those that do often require high face values, sometimes a minimum of $1 million in coverage.

Traditionally, most foreign nationals use life insurance to help pass large assets to their heirs. For that, they need the guaranteed, lifelong protection of a whole policy.

That said, some foreign nationals could benefit from temporary term coverage.

Families in which one spouse is a citizen and the other isn’t may want a more traditional life insurance policy to cover everyday debt obligations in the event of an unexpected death.

Types of Whole Life Insurance for Foreign Nationals

All whole life insurance policies offer guaranteed coverage for as long as you live. Some also come with a built-in savings account. That cash account grows differently based on the policy type you choose.

Whole life has the following variations:

- Traditional whole life

- Universal life

- Variable life

- Variable-universal life

- Guaranteed universal life

Each differs as follows.

Traditional Whole Life Insurance

A traditional whole life policy is the most common form of permanent insurance. It is also one of the simplest.

Your cash account operates similar to a traditional savings account. A portion of your premiums is placed in an account that grows at a fixed interest rate set by the insurer (typically around 3–8 percent).

Like traditional whole policies, universal policies come with a cash account that grows at a fixed rate.

They differ in that they also offer the flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low while maximizing cash value.

Indexed Universal Life Insurance

Indexed universal life policies offer all of the flexibility of a universal policy, with the added benefit of choosing how you invest your premiums.

Indexed policies allow the owner to allocate the cash value amounts to an equity index account such as the S&P 500 or the Nasdaq 100, rather than growing at a set rate.

They are riskier in that growth is not guaranteed, but they do come with the potential for higher returns than a traditional whole or universal policy.

Guaranteed Universal Life Insurance

Guaranteed universal life policies fall somewhere between a term policy and a traditional whole policy.

Unlike most permanent life insurance policies, guaranteed universal policies do not accumulate a cash value that you can access. They are more like term policies that simply don’t expire as long as you pay your premiums.

Variable Life Life Insurance

Variable policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401(k).

Variable policies come with the greatest risk, but also some of the highest growth potential.

Depending on how the stock market performs, you could lose some of your cash value and possibly see your face value decrease. Fortunately, some policies do come with a minimum death benefit guarantee.

Variable Universal Life Insurance

As their name implies, variable universal policies combine the benefits of a universal and a variable policy.

You get the flexibility of adjustable premiums and face values, along with the investment options of a variable savings account.

Which Foreign Nationals Should Buy Whole Life Insurance

As discussed, most foreign nationals buy U.S. life insurance because they have large financial interests in the country, such as a business or real estate holdings. In those cases, the life insurance policy is meant more as a way of protecting those assets and helping in the transfer of the estate.

For that reason, most insurers only offer whole life policies to non-citizens. A whole policy can be beneficial for those in the following situations.

Planning an Estate

If you’re leaving behind a large estate in the United States, your heirs could be on the hook for a significant tax bill. The current maximum estate tax rates are nearly 40 percent.

Watch the following video for more information on tax rules for life insurance benefits.

Estate taxes are due in cash within nine months of your passing. If you aren’t leaving behind any liquid assets, your heirs may have to use personal funds to cover the tax debt.

However, proceeds from life insurance policies are typically tax-free. That means your beneficiaries could use the death benefit to pay the taxes, and thereby preserve the overall value of the estate.

Protecting Assets

If you need to protect your assets against liens and creditors in the United States, life insurance could be a practical part of your strategy.

Laws vary from state to state, but most agree that life insurance proceeds are uncollectible assets.

Establishing a Trust

Similar to asset protection, the proceeds from a whole life insurance policy can be used to create a strong trust. This can be an effective way to transfer substantial assets like real estate or businesses.

If the beneficiary is also a non-citizen, the policy can be used to establish a qualified domestic trust. In this case, the trustee (the person who manages the trust) must be a U.S. citizen or a U.S. corporation such as a bank or trust company but the beneficiary (the person receiving funds) can be a non-citizen.

Preserving a Business

If you own a business, the proceeds from a whole life insurance policy can be used to cover any financial losses resulting from your death. It can also provide the liquidity necessary to keep it running and grow into the future.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Life Insurance for Foreign Nationals

Case Study 1: John – Term Life Insurance for Foreign Nationals

John is a foreign national living and working in the United States. He is interested in purchasing life insurance to provide financial protection for his family. John researches and compares quotes to find the best foreign nationals term life insurance policy starting at $12.70 per month.

Case Study 2: Maria – Whole Life Insurance for Foreign Nationals

Maria, a non-U.S. citizen, owns a business in the United States and wants to protect her assets and ensure a smooth transfer of her estate. She decides to purchase a whole life insurance policy, which offers lifelong coverage and a cash value component. Maria safeguards family’s finances and estate taxes with $1M policy.

Case Study 3: David – Life Insurance for Estate Planning

David, a foreign national with significant assets in the United States, wants to incorporate life insurance into his estate plan. He consults with a life insurance agent who advises him to purchase a whole life insurance policy. This policy will help cover estate taxes and protect his assets, ensuring a smooth transfer to his beneficiaries.

Life Insurance for Foreign Nationals: The Bottom Line

So, can a non-U.S. citizen buy life insurance? Yes. Even if you aren’t a citizen, it’s still possible to buy a life insurance policy from a U.S. insurer.

As long as you have financial interests in the United States, are in the country for the entirety of the application process, and pay for the policy with funds from a U.S. bank, you can purchase coverage to meet your specific financial needs.

Foreign nationals may have a harder time finding a low-value term policy, but high-value term and whole policies are readily available from most of the top insurers in the country.

This guide was designed to give you a comprehensive overview of the life insurance process and all of the special considerations to keep in mind if you’re a foreign national looking for coverage.

We hope that, after reading it, you have all the information you need to get started shopping for a policy.

Keep in mind that all of this information only applies to foreign nationals looking to buy life insurance in the United States.

If you’re wondering “Can a U.S. citizen buy life insurance in India?” or “Can a U.S. citizen buy life insurance in Singapore?” you’ll have to check the laws in any country you’re curious about. Laws vary greatly between countries.

Did we leave any of your questions unanswered? If so, be sure to check out one of the many in-depth guides on this site for information on every aspect of the life insurance industry.

Afterward, you can use the quote tool on this page to instantly compare quotes from multiple insurers to find the best life insurance for foreign nationals for you and your family.

References:

- https://www.iii.org/fact-statistic/facts-statistics-industry-overview

- https://www.dhs.gov/immigration-statistics/population-estimates/NI

- https://www.irs.gov/instructions/i706qdt

- https://nces.ed.gov/programs/digest/d18/tables/dt18_330.20.asp

Frequently Asked Questions

Can non-US citizens buy life insurance in the United States?

Yes, most non-citizens living or doing business in the US can qualify for life insurance for foreign nationals.

What are the top life insurance companies for foreign nationals?

The top 20 overall providers of life insurance in the US are considered some of the best options for foreign nationals.

How much does life insurance for foreign nationals cost?

Sample rates for non-smokers from top insurance companies are provided as an estimate. However, rates for foreign nationals may vary depending on additional factors.

Can a foreign national buy life insurance without a Social Security number?

Yes, if a foreign national has an ITIN number, valid visa, or green card, they can still get a life insurance policy.

What are the special considerations for life insurance for foreign nationals?

Foreign nationals need to keep in mind certain guidelines, such as being present in the US for the entire application process, providing specific documents like ITIN number or valid visa, and making premium payments in US currency from a US bank account.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.