10 Cheapest Life Insurance Companies in 2026 (Save Money With These Providers!)

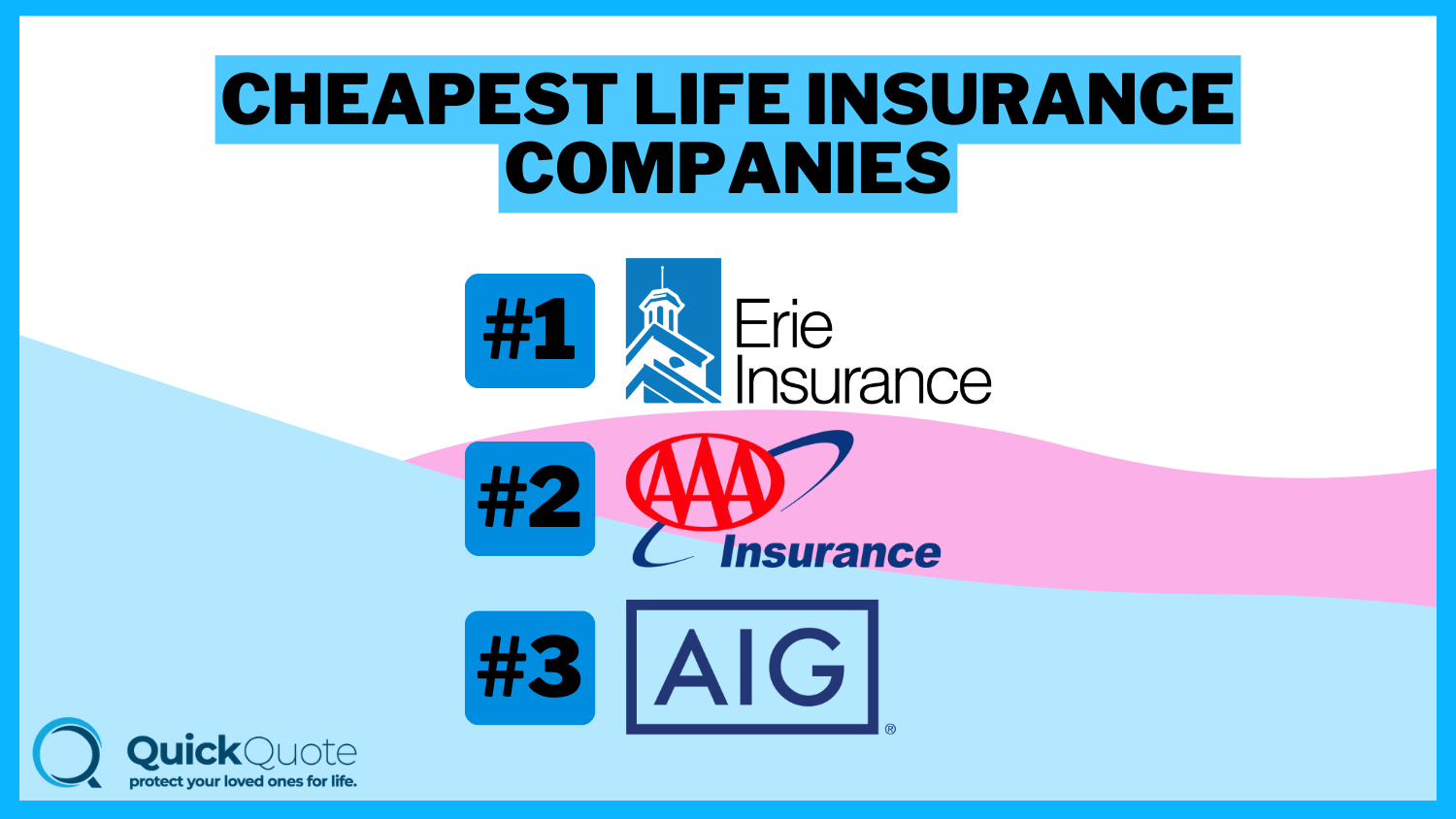

Erie Insurance, AAA, and AIG excel as the top cheapest life insurance companies, with rates starting at $42 per month. Renowned for their superior customer service, these companies provide budget-conscious individuals with reliable life insurance at competitive prices, ensuring financial security.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for Life Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Life Insurance

A.M. Best Rating

Complaint Level

Erie Insurance, AAA, and AIG emerge as the top picks among the cheapest life insurance companies, offering rates as low as $42 per month.

With comprehensive coverage options and exceptional customer service, these insurers provide budget-conscious individuals with reliable life insurance solutions.

Our Top 10 Picks: Cheapest Life Insurance Companies

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $42 A+ Financial Strength Erie

#2 $48 A Customized Policies AAA

#3 $56 A Low Rates AIG

#4 $60 A+ Competitive Rates Allstate

#5 $64 A+ Online Convenience Prudential

#6 $66 A+ Vanishing Deductible Nationwide

#7 $70 A Affordable Premiums Liberty Mutual

#8 $76 B Easy Application State Farm

#9 $82 A+ Customer Service Columbus Life Insurance

#10 $86 A++ Coverage Options Travelers

Give your loved ones the gift of financial security by entering your ZIP code above to find life insurance that doesn’t break the bank.

Compare quotes now to find the best fit for your needs and secure financial peace of mind with the most affordable rates available. To gain in-depth knowledge, consult our comprehensive resource titled “Comparing Term Life Insurance Quotes.”

- Erie Insurance is the top pick with monthly rates starting at $42

- Tailored coverage for life insurance owners’ unique needs

- Compare quotes online for peace of mind

#1 – Erie: Top Overall Pick

Pros

- Financial Strength: Erie life insurance review showcase the company’s A+ rating, ensuring reliability and stability.

- Affordable Rates: With monthly premiums starting at just $42, Erie offers cost-effective coverage.

- Excellent Customer Service: Known for its personalized service and quick claims processing, Erie provides exceptional support to policyholders.

Cons

- Limited Online Presence: While Erie offers online tools, its digital presence may be less comprehensive compared to larger insurers.

- Regional Availability: Erie’s coverage may be limited to specific regions, potentially restricting access for some customers.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#2 – AAA: Best for Customized Policies

Pros

- Customized Policies: AAA offers tailored insurance solutions to meet the unique needs of each policyholder.

- Competitive Rates: AAA life insurance review demonstrate the company’s monthly premiums starting at $48, AAA provides affordable coverage options.

- Membership Benefits: AAA members enjoy access to additional perks and discounts, enhancing the overall value of their policies.

Cons

- Limited Availability: Coverage may not be available in all areas, limiting options for some potential customers.

- Complex Membership Structure: The intricacies of AAA membership requirements and benefits may be confusing for some individuals.

#3 – AIG: Best for Low Rates

Pros

- Low Rates: AIG provides competitive pricing starting at $56 per month, making it an attractive option for budget-conscious consumers.

- Financial Strength: As an A-rated company, AIG boasts a strong reputation for financial stability and reliability.

- Flexible Coverage Options: AIG life insurance review features the company’s variety of policies available, AIG offers flexibility to cater to different insurance needs and preferences.

Cons

- Limited Policy Offerings: AIG may not have as extensive a range of specialized policies compared to some other insurers, potentially limiting options for certain customers.

- Mixed Customer Service Reviews: While some customers praise AIG’s customer service, others have reported issues with responsiveness and support.

#4 – Allstate: Best for Competitive Rates

Pros

- Competitive Rates: Allstate life insurance review highlight the company’s competitive monthly premiums starting at $60.

- Financial Strength: With an A+ rating, Allstate provides assurance of stability and reliability.

- Coverage Options: Allstate provides a range of coverage options to suit various insurance needs.

Cons

- Customer Service: Some customers have reported issues with Allstate’s customer service, citing delays and difficulties in claims processing.

- Policy Restrictions: Allstate may have stricter policy limitations compared to other insurers, potentially limiting coverage flexibility.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#5 – Prudential: Best for Online Convenience

Pros

- Online Convenience: Prudential offers user-friendly online tools and resources for easy policy management and claims processing.

- Financial Strength: Prudential life insurance company review present the company’s A+ rating, indicating strong financial stability and reliability.

- Range of Products: Prudential offers a diverse range of insurance products to meet various needs, including life, health, and retirement solutions.

Cons

- Premium Costs: Prudential’s monthly rates, starting at $64, may be higher compared to some competitors.

- Complex Policies: Some customers have found Prudential’s policies to be complex, with intricate terms and conditions that may require careful review.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible feature, allowing policyholders to lower their deductible over time with safe driving habits.

- Financial Strength: With an A+ rating, Nationwide provides assurance of financial stability and reliability.

- Wide Range of Coverage: Nationwide life insurance review display the company’s comprehensive range of coverage options to meet various insurance needs.

Cons

- Premium Costs: Monthly premiums with Nationwide start at $66, which may be higher compared to some other insurers.

- Limited Policy Flexibility: Some customers have reported limitations in policy customization options with Nationwide.

#7 – Liberty Mutual: Best for Affordable Premiums

Pros

- Affordable Premiums: Liberty Mutual life insurance review illustrate the company’s competitive monthly premiums starting at $70.

- Financial Strength: With an A rating, Liberty Mutual provides assurance of stability and reliability.

- Diverse Coverage Options: Liberty Mutual offers a wide range of coverage options to meet various insurance needs.

Cons

- Customer Service: Some customers have reported issues with Liberty Mutual’s customer service, citing delays and difficulties in claims processing.

- Policy Restrictions: Liberty Mutual may have stricter policy limitations compared to other insurers, potentially limiting coverage flexibility.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#8 – State Farm: Best for Easy Application

Pros

- Easy Application: State Farm offers a straightforward application process, making it easy for customers to obtain coverage.

- Extensive Network: State Farm has a wide network of local agents, providing personalized service and in-person support.

- Range of Products: State Farm life insurance review highlight the company’s diverse range of insurance products, including life, auto, and home insurance, to meet various needs.

Cons

- Premium Costs: Monthly premiums with State Farm start at $76, which may be higher compared to some competitors.

- Limited Policy Options: Some customers have found State Farm’s policy options to be limited compared to other insurers, potentially restricting coverage choices.

#9 – Columbus Life Insurance: Best for Customer Service

Pros

- Customer Service: Columbus life insurance is known for its exceptional customer service, providing personalized support to policyholders.

- Financial Strength: With an A+ rating, Columbus life insurance offers assurance of stability and reliability.

- Range of Products: Columbus life insurance review demonstrate the company’s variety of insurance products, including life, disability, and retirement solutions, to meet various needs.

Cons

- Premium Costs: Monthly premiums with Columbus life insurance start at $82, which may be higher compared to some competitors.

- Limited Online Presence: Columbus life insurance may have a limited online presence, with fewer digital tools and resources compared to larger insurers.

#10 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Travelers offers a wide range of coverage options, allowing customers to tailor their policies to suit their individual needs.

- Financial Strength: With an A++ rating, Travelers provides assurance of strong financial stability and reliability.

- Customization: Travelers allows for policy customization, enabling customers to adjust coverage levels and deductibles according to their preferences. To gain further insights, consult our comprehensive guide titled “Are life insurance premiums tax-deductible?“

Cons

- Premium Costs: Monthly premiums with Travelers start at $86, which may be higher compared to some other insurers.

- Claims Processing: Some customers have reported issues with Travelers’ claims processing, citing delays and difficulties in receiving payouts.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Finding Affordable Life Insurance for Every Demographic

In general, term life insurance policies are the least expensive, although whole life insurance and other permanent policies are more expensive. The cost of your life insurance policy will be impacted by a wide range of factors.

Comparing Guaranteed and Simplified Issue Life Insurance

Guaranteed acceptance insurance provides quick approval without health questions or exams, offering coverage up to $25,000 mainly for funeral expenses, with a waiting period for beneficiaries to receive the full death benefit. To delve deeper, refer to our in-depth report titled “Best Guaranteed Universal Life Insurance.”

Simplified issue insurance, also without a physical exam, considers family medical history and driving records, often offering higher coverage limits up to $150,000 and potentially lower costs based on health history, though it still has a waiting period for benefit payouts.

Factors Affecting Life Insurance Costs

Understanding what influences your life insurance rates is essential to finding the most cost-effective coverage. Several factors, such as coverage amount, policy type, and length, significantly impact your premiums.

- Amount of Coverage: Higher death benefits lead to higher premiums due to increased risk for the insurer.

- Policy Type: Term life insurance generally costs less than permanent life insurance, which includes a savings component.

- Policy Length: Longer terms in term life insurance result in higher premiums because of extended coverage periods. For a thorough understanding, refer to our detailed analysis titled “Calculate Your Term Life Insurance Needs.”

By considering these factors and comparing quotes from multiple insurers, you can secure the most affordable life insurance policy that meets your needs.

Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $48 $124

AIG $56 $130

Allstate $60 $138

Columbus Life Insurance $82 $173

Erie $42 $120

Liberty Mutual $70 $159

Nationwide $66 $152

Prudential $64 $146

State Farm $76 $171

Travelers $86 $180

Remember, the right policy not only provides financial security for your loved ones but also offers peace of mind knowing you’ve made a well-informed decision to protect their future. Start comparing quotes today to ensure you’re getting the best value and coverage for your life insurance investment.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Tips for Saving on Life Insurance Costs

To save money on life insurance, consider opting for term life insurance as it is generally less expensive than permanent life insurance. To expand your knowledge, refer to our comprehensive handbook titled “How to Save Money When Buying Life Insurance.”

Lowering the death benefit can reduce annual premiums while still supporting your beneficiaries adequately. Bundling policies, such as combining life and auto insurance, can qualify you for discounts.

At just $42 per month, Erie Insurance stands out as the best value for life insurance.Zach Fagiano Licensed Insurance Broker

Choose a payment schedule that minimizes costs, whether paying annually for a discount or opting for monthly premiums. Evaluate and skip unnecessary add-ons or riders that increase costs.

Comparing quotes online from multiple insurers ensures you find the most competitive rates. Working with an independent insurance broker can help in finding the most affordable life insurance policy tailored to your needs.

Group Life Insurance

Some businesses and member-based organizations offer group life insurance at reduced rates to their employees or members. There are a few considerations to bear in mind if group life insurance is your major source of protection:

- Pros of Group Life Insurance: Employer-provided with guaranteed acceptance regardless of age or health condition.

- Cons of Group Life Insurance: Limited coverage amounts and customization options; coverage may end if you change jobs.

The fact that group life insurance policies provide guaranteed coverage and are paid for by the company is their principal advantage. To gain profound insights, consult our extensive guide titled “What is the minimum coverage amount for life insurance?“

However, you might have to pay out of pocket if you want to personalize your coverage. Furthermore, the group provider can cap the percentage of your wage that is covered by your insurance.

Determining Your Life Insurance Needs

To calculate how much life insurance you need, consider your income, assets, liabilities, and the number of dependents. Factor in potential economic losses for your family and end-of-life expenses like funeral costs and estate taxes.

It’s important to also include less obvious sources of income, such as employer benefits and 401(k) matches, which your loved ones may rely on after your passing.

Determining your coverage needs beforehand ensures you find a policy that meets your financial obligations and fits within your budget for premiums. For a comprehensive overview, explore our detailed resource titled “Life Insurance Premiums: What are they and how do they work?”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Deciding on Life Insurance: Essential Considerations

Understanding whether life insurance is necessary depends on your financial obligations and future plans. Here’s a breakdown to help you decide.

- Reasons to Buy Life Insurance: You should consider life insurance if you have financial responsibilities to your family or dependents, want to leave an inheritance, or need to plan for future education costs or unforeseen expenses.

- When You Might Not Need Life Insurance: You may not need it if you have sufficient savings, lack significant financial dependents or debts, or own few assets or business interests. For detailed information, refer to our comprehensive report titled “Life Insurance and Financial Planning: How They Work Together.”

- Consider Term Life Insurance: Term life insurance offers level premiums for a set period, such as 20 years, making it ideal for income replacement during your working years; however, renewing after the term may result in higher costs.

Whether you opt for life insurance to protect your loved ones or determine it’s unnecessary based on your financial situation, choosing the right policy ensures peace of mind for the future. Consider your needs carefully and explore different options to make an informed decision.

By doing so, you can confidently make an informed decision that aligns with your financial goals and provides the necessary protection for your family’s well-being.

Case Studies: Finding Affordable Life Insurance Solutions

Explore how individuals like Lisa, James, and Sarah secured affordable life insurance solutions through strategic choices and provider options. These case studies illustrate effective ways to obtain comprehensive coverage while staying within budget constraints.

- Case Study #1 – Young Professional: Emily, a 28-year-old marketing executive, sought affordable life insurance to protect her family’s future. After comparing quotes, she found that Erie Insurance offered her a term life policy with a coverage amount suitable for her needs at a monthly premium of $42.

- Case Study #2 – Retired Couple: John and Mary, aged 65, sought affordable life insurance to cover final expenses and leave a small inheritance for their grandchildren. They secured a competitive whole life policy with AAA at a monthly premium of $80, fitting well within their retirement budget.

- Case Study #3 – Single Parent: David, a 35-year-old single father, wanted to ensure his children’s financial security in case something happened to him. AIG provided David with a term life insurance policy at a monthly premium of $55, offering him peace of mind knowing his children would be taken care of.

These case studies demonstrate that affordable life insurance is attainable through various strategies such as leveraging safe driver discounts, bundling policies, and exploring tailored options for different demographics. For a comprehensive analysis, refer to our detailed guide titled “Life Insurance Discounts.”

Erie Insurance emerges as the top choice for budget-conscious individuals seeking comprehensive coverage, offering full coverage at $120.Tim Bain Licensed Insurance Agent

By making informed decisions and comparing quotes, individuals can ensure financial security for themselves and their loved ones without compromising on quality coverage.

The Bottom Line on Cheap Life Insurance Companies

Erie Insurance, AAA, and AIG are leading affordable life insurance providers. Known for their customer service and comprehensive coverage, they are ideal for budget-conscious individuals. For an in-depth examination, consult our guide entitled “Compare Types of Life Insurance Coverage.”

Comparing quotes from multiple insurers remains crucial in finding a policy that best fits your needs and ensures peace of mind for your loved ones.

Start comparing companies online to find the cheapest life insurance provider near you. Enter your ZIP code now to find affordable local companies with policies that fit your needs and your budget.

Frequently Asked Questions

What are the cheapest life insurance plans available for families?

Cheap term life insurance plans offer affordable premiums for families seeking financial protection over a specified period. These policies provide coverage in case of the insured’s death during the term, making them a budget-friendly choice.

Which company offers the cheapest term life insurance for seniors?

Finding the cheapest term life insurance for seniors involves comparing quotes from insurers specializing in senior life insurance to find competitive rates based on age, health, and coverage needs.

Enter your ZIP code below to compare instant life insurance quotes from highly-rated insurers and begin investing in your family’s future.

Is Banner Life Insurance a good option for those who need coverage without a medical exam?

Yes, Banner Life Insurance offers no medical exam policies, providing convenient access to coverage for individuals who prefer to skip the medical underwriting process.

For a thorough exploration, delve into our extensive guide titled “Banner Life Insurance Company Review.”

What is the cheapest whole life insurance policy available?

The cheapest whole life insurance policies offer lifelong coverage with level premiums, including a cash value component that grows over time, providing stability and financial benefits.

How do I compare life insurance companies to find the most cost-effective option?

Compare life insurance companies based on factors like financial strength, customer service, coverage options, and premiums using online tools to find the most cost-effective policy that meets your needs.

Are there affordable permanent life insurance options for seniors over 50?

Yes, seniors over 50 can find affordable permanent life insurance options like whole life or universal life policies offering lifelong coverage and potential cash value accumulation.

For a detailed breakdown, consult our comprehensive guide named “Permanent Life Insurance.”

What factors contribute to finding the least expensive term life insurance?

Age, health status, coverage amount, and term length influence term life insurance costs, with younger, healthier individuals typically qualifying for lower premiums.

How does inexpensive life insurance differ from cheap life insurance policies?

Inexpensive life insurance refers to affordable premiums relative to coverage provided, while cheap policies emphasize affordability without compromising coverage quality or financial stability.

Why is comparing life insurance quotes crucial for finding the cheapest and best policy?

Comparing quotes allows you to evaluate premiums, coverage options, and policy features from multiple insurers to secure the best value and suitable coverage for your needs.

For an exhaustive analysis, check out our complete guide entitled “Should you pay life insurance premiums monthly or annually?”

Which affordable life insurance companies offer comprehensive coverage options?

Affordable life insurance companies like AAA, State Farm, and AIG provide comprehensive coverage options tailored to various needs and budgets, ensuring financial security for policyholders and their families.

Find cheap life insurance quotes by entering your ZIP code into our free quote comparison tool below.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.