Best Life Insurance for Inmates in 2026 (Find the Top 10 Companies Here!)

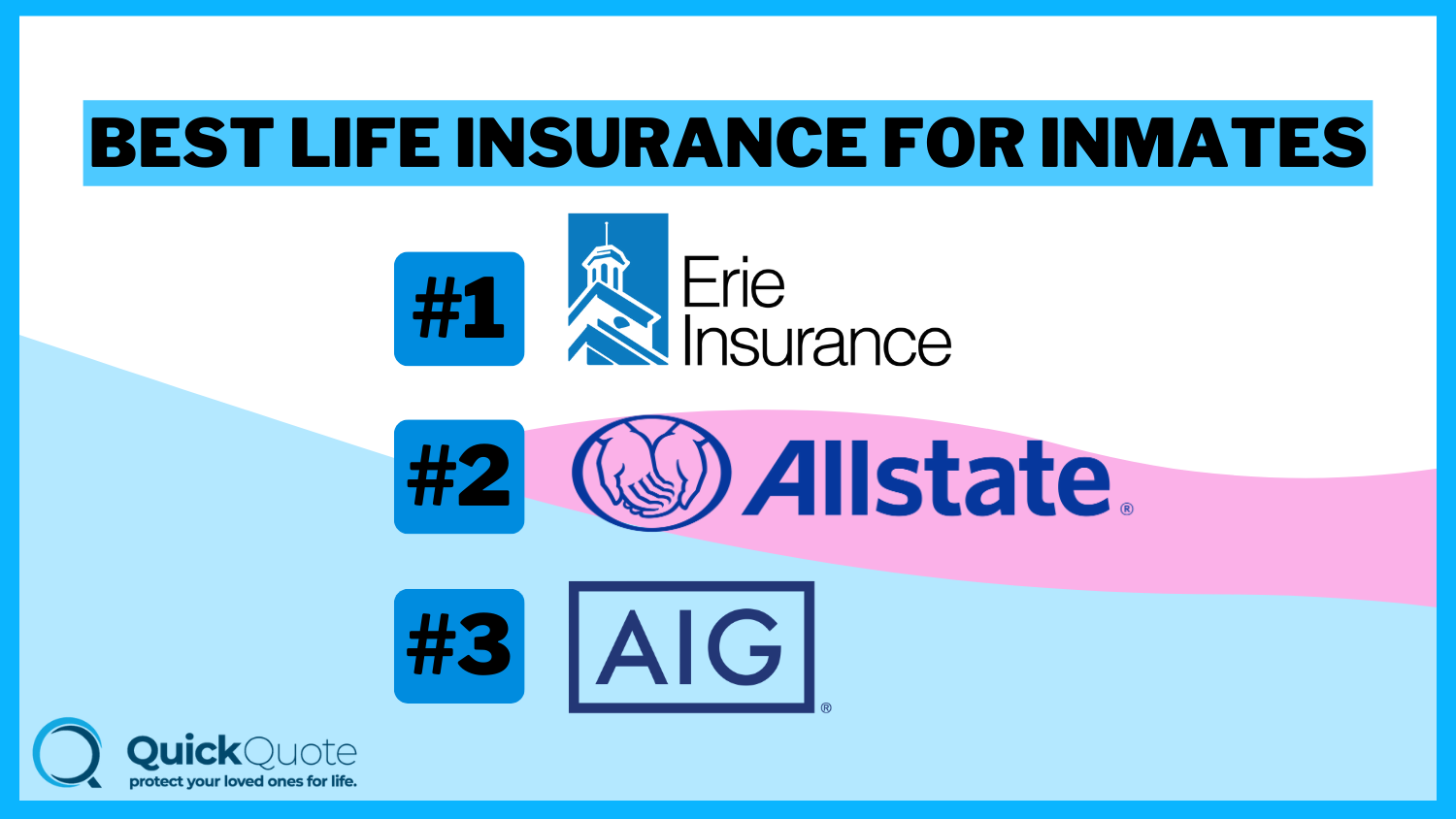

Discover the best life insurance for inmates with Erie, Allstate, and AIG leading the pack, starting at just $54 a month. These companies provide the most comprehensive and affordable coverage options for inmates, ensuring peace of mind and financial security for their futures.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Inmates

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Inmates

A.M. Best Rating

Complaint Level

The top picks for the best life insurance for inmates are Erie, Allstate, and AIG, offering comprehensive coverage tailored to this demographic’s unique needs.

These companies excel in providing policies that address the specific challenges inmates face, ensuring both affordability and reliability. Learn more on how to buy life insurance.

Our Top 10 Company Picks: Best Life Insurance for Inmates

Company Rank Multi Vehicle-Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Flexible Policies Erie

#2 25% A+ Extensive Coverage Allstate

#3 25% A Extensive Options AIG

#4 25% A Financial Stability Liberty Mutual

#5 20% A+ Comprehensive Plans Nationwide

#6 15% A++ Reliable Service New York Life

#7 12% A+ Customer Service Principal National Life

#8 8% A Competitive Rates Lincoln Life

#9 12% A+ Comprehensive Coverage Prudential

#10 20% B Reliable Claims State Farm

Through a careful selection of guaranteed issues and AD&D policies, they help secure the financial future of inmates’ families. By comparing these providers, inmates can find a plan that best suits their circumstances and offers peace of mind.

If you’re looking to protect your family’s future at a low cost, enter your ZIP code above to buy affordable whole life insurance prices with our free quote comparison tool.

- Erie leads as the top provider of life insurance for inmates

- Policies cater specifically to inmates, ensuring peace of mind

- Plans are simple and affordable, key for inmates’ financial security

#1 – Erie: Top Overall Pick

Pros

- Multi-Vehicle Discount: Erie offers a 10% discount for multiple-vehicle policies. Delve into our evaluation of Erie life insurance review.

- Strong Financial Rating: Secures an A+ rating from A.M. Best, indicating financial reliability.

- Adaptable Policies: Known for flexible policy options that can be customized to individual needs.

Cons

- Limited Availability: Erie’s insurance products are not available in all states.

- Higher Base Rates: While discounts are available, base rates can be higher compared to some competitors.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Extensive Coverage

Pros

- High Multi-Vehicle Discount: Allstate provides a 25% discount for multiple-vehicle policies. Access comprehensive insights into our Allstate life insurance review.

- Extensive Coverage Options: Offers a wide range of coverage options that meet diverse needs.

- A+ Financial Rating: Allstate’s strong financial health ensures reliability and claim-paying ability.

Cons

- Premium Cost: Despite discounts, premiums can be relatively higher.

- Claim Process: Some users report a less than satisfactory claim filing experience.

#3 – AIG: Best for Extensive Options

Pros

- Significant Multi-Vehicle Discount: AIG offers a 25% discount for customers with multiple-vehicle policies.

- Wide Range of Products: Provides a variety of insurance options that cater to different preferences and needs.

- Strong Financial Standing: Holds an A rating from A.M. Best, ensuring robust financial health. Learn more in our AIG life insurance review.

Cons

- Customer Service Issues: Some reports of less responsive customer service.

- Complex Policy Offerings: The wide range of options can be confusing for some customers.

#4 – Liberty Mutual: Best for Financial Stability

Pros

- Substantial Multi-Vehicle Discount: Offers a 25% discount for multi-vehicle policies. Read up on the Liberty Mutual life insurance review for more information.

- Solid Financial Rating: Achieves an A rating from A.M. Best, indicating strong financial stability.

- Global Presence: Well-established with a wide-reaching global presence, enhancing its service capabilities.

Cons

- Higher Premiums: Known for higher premiums in some areas compared to competitors.

- Varied Customer Satisfaction: Customer satisfaction can vary significantly by region.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Comprehensive Plans

Pros

- Strong Multi-Vehicle Discount: Nationwide offers a 20% discount for multi-vehicle policies. Access comprehensive insights into our guide titled “Nationwide Life Insurance Review.”

- Comprehensive Coverage: Known for offering extensive coverage options that provide thorough protection.

- Excellent Financial Health: Maintains an A+ rating from A.M. Best, reflecting strong financial stability.

Cons

- Costly Policies: Premiums can be expensive, especially without discounts.

- Inconsistent Customer Service: Customer service quality can vary, affecting overall satisfaction.

#6 – New York Life: Best for Reliable Service

Pros

- Good Multi-Vehicle Discount: Offers a 15% discount for multi-vehicle policies. Delve into our evaluation of the New York life insurance company review.

- Top-Notch Financial Rating: Boasts the highest possible A++ rating from A.M. Best.

- Reputation for Reliability: Highly regarded for its dependable service and strong customer trust.

Cons

- Premium Pricing: Generally higher premiums due to its high level of service and reliability.

- Less Flexibility: Fewer customizable options compared to other insurers.

#7 – Principal National Life: Best for Customer Service

Pros

- Decent Multi-Vehicle Discount: Provides a 12% discount on multi-vehicle policies.

- Focused on Service: Praised for exceptional customer service and client care. Unlock details in our guide titled “Principal National Life Insurance Review.”

- Strong Financial Rating: Maintains an A+ rating from A.M. Best, ensuring financial reliability.

Cons

- Narrower Coverage Options: Less diversity in policy options than larger insurers.

- Premium Costs: Competitive but can be higher relative to some other insurers with similar offerings.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#8 – Lincoln Life: Best for Competitive Rates

Pros

- Competitive Multi-Vehicle Discount: Offers an 8% discount for multiple vehicle policies.

- Competitive Pricing: Known for offering some of the most competitive rates in the industry.

- Solid Financial Rating: Holds a strong A rating from A.M. Best. Discover more about offerings in our complete comparison of “AIG vs. Lincoln Life Insurance.”

Cons

- Limited Global Reach: More limited presence compared to larger global insurers.

- Basic Coverage Options: More basic and straightforward coverage options, which may not suit all needs.

#9 – Prudential: Best for Comprehensive Coverage

Pros

- Substantial Multi-Vehicle Discount: Prudential offers a 12% discount for customers with multiple vehicles.

- Wide Coverage: Known for its comprehensive coverage options. Find out more in our guide titled “Prudential Life Insurance Company Review.”

- Excellent Financial Health: Holds an A+ rating from A.M. Best, reflecting strong financial stability.

Cons

- Higher Premiums: Generally higher premiums for its comprehensive coverage.

- Complex Policy Structures: Some customers find the policy options and structures complex to navigate.

#10 – State Farm: Best for Reliable Claims

Pros

- Significant Multi-Vehicle Discount: Offers a 20% discount for multi-vehicle insurance policies.

- Renowned for Reliable Claims Process: Known for a straightforward and reliable claims process.

- Diverse Coverage Options: Offers a variety of coverage options tailored to different needs. Unlock details in our State Farm life insurance review.

Cons

- Higher Premium Costs: Despite discounts, premiums might still be relatively higher.

- Limited Multi-Policy Discount: The multi-policy discount is not as competitive as some peers.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Inmate Life Insurance Coverage Rates Overview

When selecting the best life insurance for inmates, understanding the monthly rates for both minimum and full coverage across different providers is crucial. This comparison allows potential policyholders to gauge the financial commitment required for each level of coverage.

Inmate Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $58 $112

Allstate $60 $115

Erie $55 $110

Liberty Mutual $62 $120

Lincoln Life $56 $111

Nationwide $57 $113

New York Life $61 $118

Principal National Life $59 $114

Prudential $63 $122

State Farm $54 $108

The table details monthly rates for both minimum and full coverage offered by several insurance companies, tailored specifically for inmates. State Farm emerges as the most budget-friendly option, with minimum coverage starting at $54 and full coverage at $108.

On the higher end, Prudential’s full coverage rate reaches $122, reflecting its comprehensive benefits. Other notable companies like Erie and Lincoln Life offer competitive rates, with Erie providing minimum coverage at $55 full coverage at $110, and Lincoln Life slightly higher at $56 and $111, respectively.

These rates provide a spectrum of choices, enabling inmates and their families to find a plan that balances cost with the desired level of financial security. See more details on our “What is the minimum coverage amount for life insurance?”

Can You Get Life Insurance for Someone in Prison

An inmate’s life insurance eligibility depends on several factors, including age, medical history, and lifestyle. Insurance companies likely won’t write policies for high-risk individuals in prison or awaiting trial.

BQ: The best chance for an inmate to obtain life insurance is a guaranteed universal life insurance policy, which may not ask questions about health or criminal background.

However, guaranteed life insurance coverage is limited, usually only offering up to $25,000 in death benefits. In addition, most companies require you to be over 50 to qualify for these policies, but some will offer coverage to those as young as 45.

The table below shows where you can buy guaranteed issue life insurance:

The Best Guaranteed Issue Life Insurance Companies

Insurance Company Age Availability Waiting Period Waiting Period Payout Minimum Coverage Limit Maximum Coverage Limit

AAA 50-85 2 years Premiums paid + 30% interest $5,000 $25,000

AIG 50-85 2 years Premiums paid + 10% interest $5,000 $25,000

Gerber Life 50-80 2 years Premiums paid + 10% interest $5,000 $25,000

Mutual of Omaha 45-85 2 years Premiums paid + 20% interest $2,000 $25,000

New York Life 50-80 2 years Premiums paid + 10% interest $2,500 $15,000

Mutual of Omaha and AAA offer the largest death benefit during the waiting period, but maximum life insurance coverage doesn’t exceed $25,000. Life insurance rates for inmates may also be more expensive, so compare quotes from these and other local companies before you buy.

If you don’t qualify for guaranteed issue life insurance, you may be able to buy accidental death life insurance (AD&D) from certain companies. AD&D insurance does not require a medical exam but only covers accidental death or loss/loss of use of a limb.

For example, if the insured is injured or killed while committing a crime or dies of natural causes, the insurance company would deny death benefits on an AD&D policy (For more information, read our “Life Insurance vs. Accidental Death & Dismemberment (AD&D) Insurance: Which Is Better for You“).

Like guaranteed issue insurance, AD&D benefits are minimal and only cover funeral and burial costs. However, AD&D life insurance rates are often cheaper, and it’s also easier to qualify for this coverage than other types of life insurance.

Additionally, if you have group life insurance through your employer, you may be able to add an inmate to your policy if they are your spouse or dependent. However, the group policy limits coverage terms. Research your policy thoroughly before buying life insurance for someone in prison.

What Happens to Life Insurance if You Go to Prison

If you had a life insurance policy in place before you were incarcerated, death benefits would still apply if you continue to pay your rates. The same applies if you are the life insurance beneficiary of an incarcerated individual — you will still receive a benefit upon the insured’s death.

However, this may not be the case for those who get life insurance through their employer. If you don’t have the option of converting your group life insurance to an individual policy, you will most likely lose coverage.

Can a Death Row Inmate Get Life Insurance

A death row inmate most likely can’t buy life insurance. However, if they have an existing life insurance policy, their beneficiaries could still receive their death benefit. This will depend on the specifics of the life insurance policy.

How to Buy Life Insurance for Inmates

If you are in prison or currently awaiting trial, you may not be able to apply for life insurance coverage at all. If you cannot get life insurance in prison, you will have more options after your release. However, with a felony record, you will have to wait some time after your release to buy a new policy.

On average, inmates wait a year after their probationary period to apply for life insurance.

Depending on your criminal record, you may be able to get life insurance coverage soon after your release from prison.

Melanie Musson Published Insurance Expert

For example, non-violent felonies carry lower risk and are less likely to impact your eligibility for life insurance than a violent crime.

How Does a Felony Impact Life Insurance

Life insurance for felons can be easier to qualify for than life insurance for inmates. Though some companies will deny you coverage, high-risk life insurers will provide guaranteed issue or term life insurance to those with criminal records. Unfortunately, your insurance rates will be higher due to the risk associated with your felony.

If you’re in prison, life insurance companies look at three things when assessing your risk level:

- The time between incarceration and the life insurance application

- The severity of the crime committed

- The number of times you’ve been incarcerated

While insurance companies may not deny you outright for a felony, certain factors can disqualify a person from life insurance. For example, a history of alcoholism, attempted suicide, or drug abuse — alongside criminal behavior — will make you too risky to insure. You may check our guide titled “Best Life Insurance for Alcoholics.”

Consider these common questions life insurance agents ask felons to give you an idea of how your criminal charges can influence the insurance-buying process.

- How long were you incarcerated?

- How much time has passed since the crime?

- Did you serve probation?

- What steps have you taken toward rehabilitation?

- Had you committed crimes before the felony in question?

Your answers to these questions will determine your eligibility for coverage and insurance rates. Each company will consider these factors differently, so it’s important to shop with multiple insurers before buying a policy.

You can reduce your risk and rates by finding steady employment and maintaining a healthy lifestyle and hobbies.

When writing your policy, many life insurance companies consider your recreational activities, social activities, medical history, and criminal record. Any steps you take toward rehabilitation can reduce your life insurance rates considerably.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Life Insurance for Inmates: What You Need to Know

Getting life insurance for someone in prison will be challenging. You will be limited to shopping with companies that offer guaranteed issue or accidental death and dismemberment insurance. These life insurance policies typically do not ask about medical or criminal history but limit death benefits to $25,000 or less.

The best life insurance companies for inmates are Mutual of Omaha and AAA, as they provide a larger payout on guaranteed issue life insurance. However, your life insurance rates will likely be more expensive.

Choosing Erie means opting for a provider that consistently delivers peace of mind through specialized inmate insurance plans.

Brad Larson Licensed Insurance Agent

If you want to find affordable life insurance for inmates, wait until the sentence is complete before buying a policy.

Life insurance coverage is easier to find when out of prison, but companies still expect inmates to wait at least a year before applying for coverage. Life insurance rates decrease, and more policy options become available as time passes.

If you’re ready to buy life insurance, shop for multiple life insurance quotes before choosing a policy to compare companies and find one that offers the most affordable life insurance for inmates.

Case Studies: Best Life Insurance for Inmates

Selecting the right life insurance for inmates is essential to ensure financial security and peace of mind. The following case studies, based on real-world scenarios, illustrate how Erie, Allstate, and AIG effectively meet the unique needs of their clients.

- Case Study #1 – Flexible Solutions With Erie: John, currently serving a medium-term sentence, sought a life insurance policy that could accommodate his situation. Erie provided him with a flexible policy that covered his needs at an affordable cost, ensuring his family’s financial security.

- Case Study #2 – Extensive Coverage From Allstate: Sarah, who was about to be released from prison, looked for a life insurance plan that offered comprehensive coverage. Allstate offered her a policy with extensive coverage options that addressed her concerns about future health issues and rehabilitation.

- Case Study #3 – Diverse Options With AIG: Mark, facing long-term incarceration, needed a life insurance policy that would remain beneficial throughout his sentence and beyond. AIG provided multiple insurance options that allowed him to secure the financial future of his dependents despite his incarceration.

These scenarios underscore the importance of choosing a life insurance provider that offers tailored solutions to inmates, ensuring they and their families are adequately protected. Learn more in our complete “Life Insurance for Felons.”

Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool below and find coverage that fits your budget and needs.

Frequently Asked Questions

Can you get life insurance for someone in prison?

Obtaining life insurance for inmates is difficult, yet certain insurers provide guaranteed issue or Accidental Death & Dismemberment (AD&D) policies that offer restricted coverage.

Access comprehensive insights into our guide titled “What are the benefits of buying life insurance?“

What happens to life insurance if you go to prison?

Can a death row inmate get life insurance?

Generally, death row inmates can’t buy life insurance, but existing policies may pay out to beneficiaries.

Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool below and find coverage that fits your budget and needs.

How to buy life insurance for inmates?

Purchasing felony life insurance while incarcerated is challenging, yet possibilities expand upon release. Felonies affect both eligibility and premiums, with insurers evaluating risk using factors such as criminal history, health, and lifestyle.

What do you need to know about life insurance for inmates?

For inmates, there are limited options like guaranteed issues or AD&D policies; however, the best life insurance for felons becomes more attainable after release, although there may be waiting periods involved.

For additional details, explore our comprehensive resource titled “Getting Life Insurance.”

What options are available for life insurance for inmates?

Life insurance for inmates typically includes guaranteed issue policies, which do not require a medical exam and offer limited coverage.

Can you get insurance for someone in prison?

Yes, it is possible to obtain guaranteed issue life insurance for someone currently in prison.

Is burial insurance for inmates available?

Yes, burial insurance, a form of final expense insurance, is available for inmates with limited coverage amounts.

What happens to life insurance if you go to jail?

Existing life insurance policies remain valid if premiums are continued to be paid while incarcerated.

Access comprehensive insights into our guide titled “Compare Types of Life Insurance Coverage.”

Are there specific life insurance policies for prisoners?

Yes, prisoners are generally eligible for accidental death and dismemberment (AD&D) insurance or guaranteed issue life insurance.

Can you get life insurance on an inmate?

Yes, one can purchase guaranteed issue life insurance for an inmate, which usually does not require a medical exam.

What happens if a life insurance beneficiary is incarcerated?

If a life insurance beneficiary is incarcerated, they can still receive the benefits unless the policy specifically excludes them.

How does a life insurance background check impact eligibility?

A life insurance background check can affect eligibility and premiums, particularly if it reveals a criminal record.

To learn more, explore our comprehensive resource on “Life Insurance Savings Account: What You Need To Know.”

Can someone with a life insurance criminal record obtain coverage?

Individuals with a criminal record can still obtain life insurance, but options may be limited to higher-risk policies.

Can convicted felons get life insurance?

Convicted felons can get life insurance, typically through guaranteed issues or high-risk policies.

What are the insurance options for those with criminal convictions?

Insurance options for those with criminal convictions include high-risk or guaranteed issue policies.

Who gets the money if a beneficiary is incarcerated?

An incarcerated beneficiary can still receive life insurance money unless the policy terms specifically prevent it.

To find out more, explore our guide titled “Calculate Your Term Life Insurance Needs.”

What is final expense insurance for inmates?

Final expense insurance for inmates provides coverage for burial and funeral costs, typically without requiring a medical exam.

How does incarceration affect existing life insurance?

Incarceration does not affect existing life insurance as long as premiums continue to be paid.

Which are considered the best prisons in the world?

The best prisons in the world are often those that focus on rehabilitation and humane conditions, like Halden Prison in Norway.

Our quote comparison tool below will allow you to shop for affordable life insurance rates from the top companies near you — just enter your ZIP code to get started.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.