American-Amicable Life Insurance Company of Texas Review [2026]

American Amicable term life policies start as low as $12/mo. The American Amicable Life Insurance company is rated by the Better Business Bureau with an 'A+' and has a strong 'A' financial rating from AM Best. Scroll down to read more in our American Amicable life insurance review.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jul 29, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

American Amicable Company Overview

| Key Information | Company Specifics |

|---|---|

| Year Founded | 1910 |

| Current Executives | CEO – Lanny Peavy President – Joe Dunlap CFO – Darla Schaffer |

| Number of Employees | 200 |

| Total Assets | $313,099,895 |

| HQ Address | 425 Austin Ave. Waco, TX 76701 |

| Phone Number | 1-254-297-2777 |

| Company Website | www.americanamicable.com |

| Premiums Written – Individual Life | $2,056,490 |

| Financial Standing | $15,400,000 |

| Best For | Strong Financial Standing; Term Life With No Exam |

American Amicable has been in business for over 100 years and is no newcomer to life insurance. With customer praise and the highest ratings to boast, American Amicable has a longstanding reputation of providing some of the cheapest prices for term life and whole life insurance options.

Stay tuned This review will tell you everything you need to know about life insurance and give you the opportunity to find the best term life insurance quotes from the right company for you.

Why wait to save money on life insurance? Before diving into our review, click on our FREE quote tool above to compare rates from top insurance companies now.

How do I shop for American Amicable life insurance?

One of the best financial decisions you can make is shopping around for life insurance quotes. Because life insurance premiums are usually paid in a term, like a contract, what seems like a small difference can cost you a small fortune.

For example, over a 30-year term, paying $20 a month instead of $17 a month costs you over $1,000 during the life of the term. Imagine saving $1,000 by getting a quick life insurance quote.

Take advantage of this detailed review to save big.

Read more: American Amicable vs. Mutual of Omaha Life Insurance

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What are the average American Amicable life insurance rates?

You may be wondering how affordable the American Amicable Life Insurance company is.

The average for the insurer’s life insurance policies is expected to cost about $120 covering clients 25–65, with rates starting as low as $11.61 a month. The average non-smoker can expect to spend $15 to $60 a month on insurance premiums, depending on coverage and term length.

American Amicable Life Insurance Average Monthly Rates by Policy Amount & Gender– 10-Year Term

| Policy Holder Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female |

|---|---|---|---|---|

| 25 | $14.04 | $11.52 | $22.50 | $16.43 |

| 30 | $13.05 | $11.61 | $20.48 | $16.88 |

| 35 | $13.86 | $12.51 | $22.73 | $19.13 |

| 40 | $15.48 | $13.68 | $27.68 | $22.50 |

| 45 | $18.99 | $15.93 | $37.80 | $28.35 |

| 50 | $24.30 | $19.62 | $51.08 | $37.80 |

| 55 | $35.37 | $25.83 | $78.30 | $54.00 |

| 60 | $56.25 | $40.50 | $128.93 | $88.88 |

| 65 | $87.57 | $61.38 | $206.33 | $139.28 |

As you can see above, males tend to pay a bit more than women for life insurance. Do note that the rates above are for non-smokers. The typical life insurance rates increase with age. This is a great reason to shop for life insurance early. See life insurance rates by age and gender for more information.

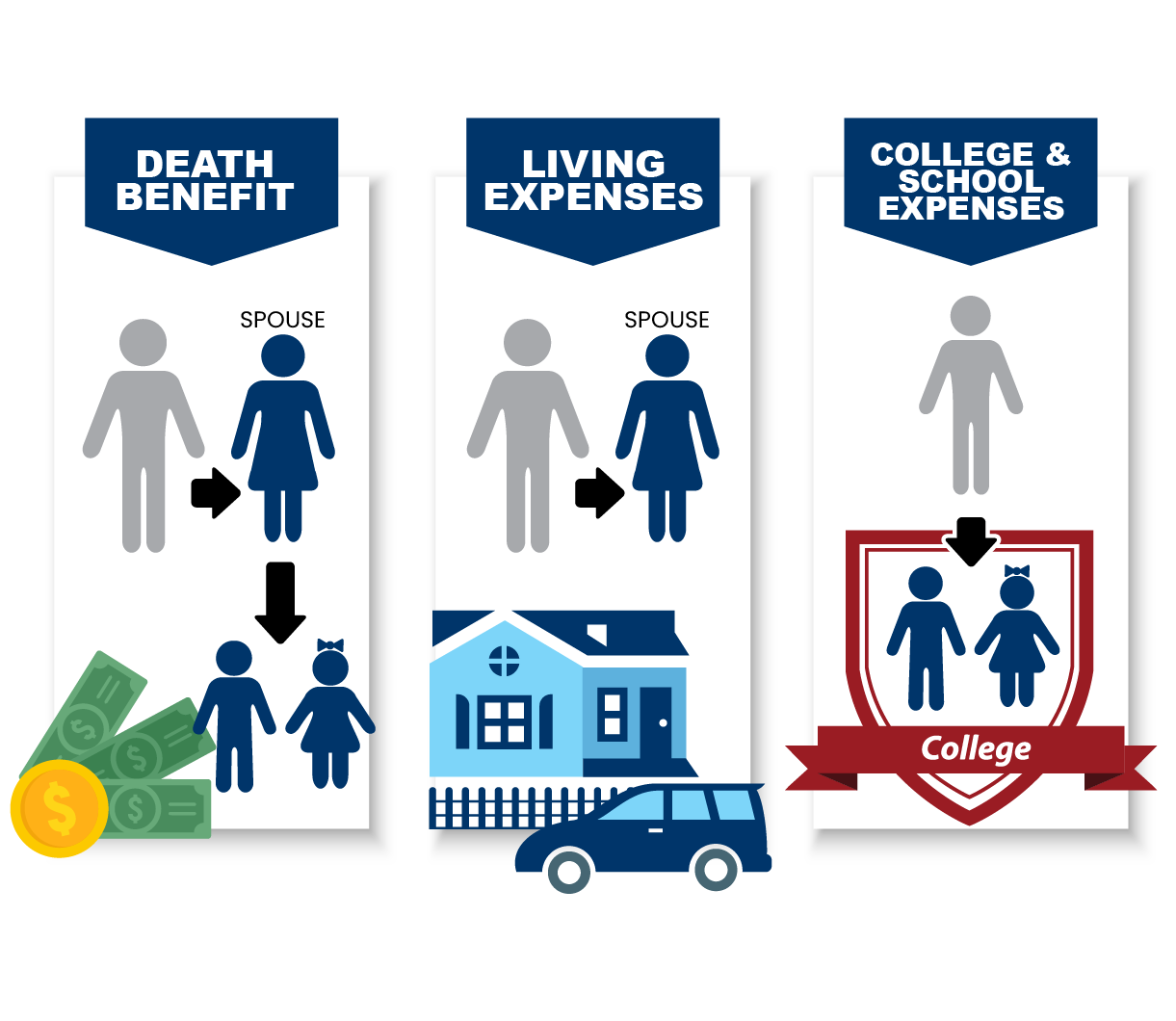

What types of American Amicable life insurance policies are offered?

The company offers several policies to benefit many prospective clients. Life insurance policies for parents might include term and whole life insurance, which can provide support for your spouse or children in the event of a catastrophic life event resulting in death.

Final expense and burial insurance might be one of the ideal life insurance policies for seniors to help reduce the financial burden of a funeral on family members.

Universal life insurance might be a beneficial life insurance policy for spouses since the rates are more flexible over time.

Over time, life insurance policies for adults become more important.

With any company, rates tend to climb as age progresses since our life eventually has to end. This could be another good reason to enroll in life insurance policies for children with a term life insurance policy. At the end of the day, it’s better to be safe than sorry.

If you’re still unsure about what each life insurance policy is, a life insurance terms glossary can help.

Whatever policy you choose, be sure to communicate with your beneficiaries. According to the NAIC, you would be surprised how much money goes unclaimed due to a lack of communication in America. Life insurance dividends shouldn’t go unclaimed.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What is term life insurance?

With premiums starting as low as $11.52 a month, American Amicable offers a variety of term life insurance plans. Choose between 10-, 20-, and 30-year terms with coverage up to $250,000.

The insurer also offers an express term life insurance which means there is no exam as part of the life insurance underwriting process and your premiums are guaranteed to remain level (stay the same) for the entire term insurance contract.

Another term life insurance policy from American Amicable is a group plan offered to people 18-65 years of age who are government employees, first responders, employees of state-funded educational institutes, hospital employees, railroad employees, or a spouse of any of the above.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What is whole life insurance?

Designed to keep a stable rate over any duration, American Amicable offers whole life insurance plans with some different options. Titled Golden Solution, these plans can include an immediate death benefit, graded death benefit, or return of premium death benefit, alongside other riders.

The whole life insurance policies include features such as not requiring a medical exam, no-cost accelerated benefits, fixed premiums, and death benefits, and a cash value accumulation feature.

What is universal life insurance?

They offer two universal life insurance options.

The first option is a non-medical universal policy. This policy offers flexible premiums and adjustable benefits. As an added bonus, you can qualify for this plan without an exam or blood work.

The company’s second option is a fully underwritten universal policy. While this policy does require a medical exam and blood work, it still offers the same flexible premiums and adjustable benefits. With this policy, there is no stated maximum coverage amount.

What is burial & final expense insurance?

American Amicable’s burial insurance (also known as American Amicable senior choice) is offered to those 50 years and older. Like term life insurance, these rates are determined by factors such as age, gender, and smoking. These no-exam rates start at $14.30/month.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What other life insurance products are offered?

For homeowners, the insurer does offer a mortgage term life insurance policy. (Find out if mortgage term life insurance is right for you.) It also has accidental death, dismemberment policies, and even the survivor protector.

American Amicable offers what is called a return of Premium which is a simplified issued whole life policy that pays a return of premium plus 10% interest for 3 years if you are under age 65, 2 years if you are age 65 or older, and 100% paid for accidental death.

What are life insurance riders?

Though it doesn’t have a specific policy for people who have a disability, it does include a disability rider for clients. Other riders include accidental death, children’s insurance, and waiver of premium.

In addition, if you’re looking for living benefits, it does offer an accelerated living benefit rider with a lump-sum payment that is paid in full in the event the insured is diagnosed with a qualifying illness.

It’s always a good idea to find out if you need life insurance riders, but expect to pay an increased rate for them.

How can I get a quote online?

You may be wondering how to get an insurance policy through American Amicable Life Insurance. With the world revolving around a busy schedule, it’s valuable to know how to get life insurance quotes online.

The best way to get life insurance quotes for American Amicable life insurance starts with its website. Finding an insurance policy has never been easier.

Visit the website. It has the resources you need to start your quote directly on its website. Click the “Find an Agent” tab.

Enter your contact information and wait for the best insurance agent to respond. With an easy-to-fill system, American Amicable should contact you in no time to discuss your life insurance policy.

It doesn’t appear that there is an app you can download for your phone. However, their site is mobile-friendly, and that includes the application process. Therefore, obtaining mobile quotes is still simple.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How do I cancel my Amicable insurance policy?

Before committing to any insurer, it’s important to know if you can cancel your life insurance policy.

Life happens. Whether it be financial hardships, better rates, moving, a change in living situation, or the basic desire to be free from an expense, you’ll be comforted knowing that you can cancel your American Amicable life insurance policy.

American Amicable Customer Service Information

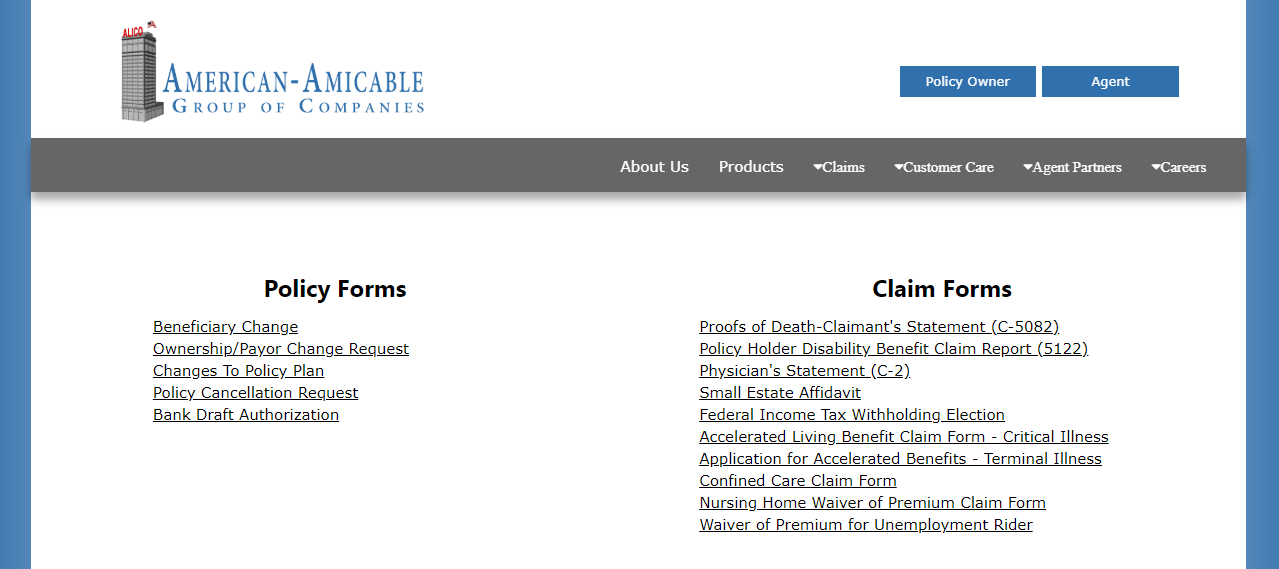

To cancel your life insurance policy, we recommend you have your policy details available to you. Once you review those details, which include potential refunds or penalties, you can then proceed to the policy cancellation process.

You can get a jump start on the process by completing your policy cancellation request form. You can contact them directly at its toll-free number 1-800-736-7311, Monday-Friday, 8 a.m- 5 p.m. You can also email them at [email protected].

If you’re local, you may want to simply call the American Life Insurance Company phone number from their website or visit the American life insurance company address to find out more information.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How can I make a claim?

Another important aspect of choosing life insurance is knowing the claims process. It’s valuable to know how long you have to make a life insurance claim, how long it takes, and the best way to make it.

The company makes making a claim easy. You have the option of simply contacting their service department or you can create an account to submit your claim via their company portal.

You can also find the necessary claim forms on their website or contact them at 1-800-736-7311.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How is the customer experience?

No insurance company can please everyone, yet we still like to know what other customers have to say about their life insurance company. The Better Business Bureau shows very little customer feedback, which means American Amicable hasn’t had major complaints.

According to the Better Business Bureau, which rated American Amicable as an A+ business, there are currently 17 customer complaints. The worst customer experience reviews were revolving around billing or product issues.

The best reviews express gratitude for need-specific policies, competitive rates, and overall ease for the insured. Due to its history and customer reviews, this shows that American Amicable Life Insurance is a reliable insurance company.

What does the design of the website/app look like?

American Amicable has a basic and user-friendly website. The site includes policies, quotes, forms, claims, and other amenities necessary for a positive customer experience. Through the website, you can change your address with American Amicable Life Insurance and purchase life insurance.

What is the history of American Amicable?

American Amicable Life Insurance’s history began in 1910 under the name Amicable Life Insurance Company, or ALICO. Headquarters are located in Waco, Texas, where operations are ongoing in the original ALICO building.

The company is one of many subsidiaries, such as Pioneer Life Insurance, within iA Financial Group as of 2010. You can see how it relates to using the Pioneer American Insurance Company customer service number. (For more information, read our “Pioneer American Life Insurance Review“).

However, don’t confuse it with iA American Life Insurance company. If you have more questions about things like who owns American Amicable, revisit the table atop the page.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How are American Amicable life insurance review ratings?

The American Amicable Life Insurance rating through the Better Business Bureau is currently an A+.

American Amicable’s AM Best rating is an A for financial strength. The long-term outlook looks stable with iA Financial Group in its corner.

The financial strength of your insurer is important to consider since it will give you an idea of their future and their ability to pay your beneficiaries when necessary.

What is the company’s market share?

While not a peak market shareholder, the American Amicable insurance company ranks similarly to many typical life insurance competitors. Major insurance companies such as State Farm insurance might be considered outliers in market share.

Top 10 Life Insurance Companies & American Amicable by Market Share

| Companies | Market Share |

|---|---|

| Northwestern Mutual | 6.42% |

| Metropolitan Life | 6.00% |

| New York Life | 5.68% |

| Prudential | 5.57% |

| Lincoln National | 5.36% |

| MassMutual | 4.19% |

| Aegon | 2.94% |

| John Hancock | 2.83% |

| State Farm | 2.83% |

| Minnesota Mutual Group | 2.70% |

| American Amicable | N/A |

However, as you can see in the table, American Amicable doesn’t even rank in the top 125 companies, according to the National Association of Insurance Commissioners.

What is American Amicable’s online presence?

American Amicable isn’t one of the primary insurance companies using social media. Though it does have some social media accounts, it isn’t well-followed or active. Claims to employ a marketing strategy with independent marketing organizations.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Does American Amicable have commercials?

With a strong focus on reputable networking, American Amicable doesn’t use many life insurance TV commercials to promote its products. Without a strong advent presence, you might wonder, is American Income Life Insurance legitimate?

Is the company involved in the community?

American Amicable, through iA Financial Group, is one of many businesses that help the community. This group showed multiple examples of giving back to the community. In one of those examples, iA Financial Group donated $50,000 to the Canadian Red Cross to support flooding relief.

Not only were they one of the best workplaces for giving back to the community in 2019 with that generous donation, but their organization has also hosted a philanthropic contest to raise funds for different charities. This is clearly one of the companies that do good for the community.

Are its employees happy?

According to Indeed.com, employees have rated their experience as a 4 out of 5. Employees note a productive environment and fast-paced work but some hardships with difficult agents. Jobs are said to include good benefits and substantial bonuses.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What are the pros & cons?

Now for the next key, simplifying the pros and cons of a life insurance company. Every company has its specialties, whether it be cheap rates, high limits, multiple plans, or more. Below are just a few of the pros and cons of life insurance policies.

What are the pros?

There are many benefits to choosing a company like American Amicable Life Insurance. We’ve discussed many, but we emphasize these points:

- Term life insurance with no exam

- Strong financial standing

- Ease of use

It’s good to know that your insurance company will be able to support your family in your time of need.

What are the cons?

With every good company comes some challenges. Here are some reasons that American Amicable might not be the best for you:

- Low coverage limits

- No 24/7 claims

- No mobile app

- No special discounts/programs

One could argue that convenience is an issue with the insurer depending on how urgent they feel a life insurance claim is. It has yet another typical Texas life insurance customer service phone number instead of advanced technical features.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Comprehensive Insights into American Amicable Life Insurance Company of Texas

American Amicable Life Insurance Company of Texas has garnered attention for its diverse range of insurance products and services. Customers frequently consult American Amicable reviews to gauge the company’s performance and customer satisfaction.

The company’s standing in the industry is often reflected in its American Amicable rating, which plays a crucial role in influencing potential clients. When seeking insurance options, many individuals look for American Amicable quotes to compare pricing and coverage options.

Additionally, American Amicable group reviews provide insights into the experiences of larger client groups. A notable aspect of the company’s credibility is its American Amicable A.M. Best rating, an indicator of financial strength and stability.

Despite its strong reputation, there are American Amicable complaints that prospective customers should be aware of. For direct inquiries, the American Amicable phone number is a valuable resource.

For those interested in life insurance, American Amicable Life Insurance quotes offer competitive rates and comprehensive coverage. The convenience of modern technology is evident in the American Amicable mobile app, designed to facilitate easy management of policies.

As a key player in the insurance market, the American Amicable Life Insurance Company of Texas remains committed to its clientele. The American Amicable Life Insurance phone number is available for customer support and assistance.

Agents looking to partner with the company can explore American Amicable contracting opportunities. The American Amicable express payment feature ensures timely and hassle-free premium payments.

Additionally, the company offers specialized plans like the American Amicable final expense plan, tailored to meet specific needs. Overall, American Amicable Life Insurance of Texas continues to be a reliable choice for many seeking robust insurance solutions.

In-Depth Review of American-Amicable Life Insurance Company of Texas

The American Amicable Group of Companies has established itself as a notable entity in the insurance industry, offering a variety of products to meet the diverse needs of its customers.

Among the services offered by American Amicable are comprehensive life insurance policies, including American Amicable final expense plans designed to cover end-of-life costs. Feedback from clients is essential, and American Income Life Insurance reviews often highlight the company’s strengths and areas for improvement.

For agents, the American Amicable agent portal is a crucial tool for managing client information and policies efficiently. The American Amicable Life Insurance customer service is known for its responsiveness and support, helping policyholders navigate their options and resolve issues.

Convenience is further enhanced by the option for American Amicable payment online, allowing customers to manage their premiums with ease. Residents of Texas seeking the best life insurance Addison Texas has to offer often find American Amicable to be a top contender.

Moreover, insights from Better Life Insurance reviews can guide potential clients in making informed decisions. Mortgage protection is another critical area, with American Amicable mortgage protection insurance providing valuable security for homeowners.

Policyholders can easily check their American Amicable login payment status to stay updated on their accounts. The reputation of the company is also reflected in American Income Life ratings from the Better Business Bureau ratings, which offer an overview of customer satisfaction and business practices.

The distinctive American Amicable logo represents a brand that many have come to trust. However, for a balanced view, it’s important to consider the American Amicable BBB rating to get a full picture of the company’s performance in the marketplace.

Overall, the American Amicable Life Insurance Company of Texas continues to be a reliable choice for those seeking comprehensive insurance solutions tailored to their needs.

Frequently Asked Questions

Life insurance company FAQs and answers can be never-ending. With endless policies, terms, riders, and more, it can sometimes be of service to review insurance company FAQs.

While we always recommend learning the basics about life insurance first, below we highlight some key FAQs.

What is American-Amicable AML?

American Amicable AML is an anti-money laundering course and is only available for people that have contracted or intend to contract with American-Amicable Life Insurance Company

Can I buy American Amicable Life Insurance online?

Yes, you can buy coverage online via its website.

Does American Amicable Life Insurance offer car insurance?

There is no evidence that the company also sells car insurance.

Does American Amicable offer discounts?

Discounts are very unusual in life insurance, and American Amicable is no different. Rates depend on other factors instead.

Is American Amicable legit?

Yes, American Amicable is a legitimate insurance provider. It is a well-established company with a long history in the life insurance industry, offering a range of insurance products and services to its clients.

What does graded death benefit mean?

A graded death benefit refers to a type of life insurance policy where the death benefit increases over time. In the early years of the policy, the payout amount may be lower, but it gradually increases until it reaches the full benefit amount.

Who owns American Amicable Life Insurance Company?

American Amicable Life Insurance Company is owned by the American Amicable Group of Companies, which is part of the larger American-Amicable financial group.

Who is the most trustworthy life insurance company?

Determining the most trustworthy life insurance company can vary based on personal experiences and needs, but companies with high ratings from independent agencies, such as Northwestern Mutual and New York Life, are often regarded as highly trustworthy.

What companies are under American-Amicable?

The companies under American-Amicable include a range of insurance and financial services entities, such as American Amicable Life Insurance Company of Texas and American-Amicable Life Insurance Company.

Is AIG insurance owned by China?

No, AIG insurance is not owned by China. AIG (American International Group) is an American multinational insurance corporation, although it has significant global operations and investments.

Does AIG life insurance pay out?

Yes, AIG life insurance policies do pay out benefits to beneficiaries upon the death of the insured, provided that the policy terms are met and premiums are paid.

Why is AIG too big to fail?

AIG was considered too big to fail due to its extensive involvement in the global financial system and its interconnectedness with other major financial institutions, which posed systemic risks if it were to collapse.

How much did the American-Amicable lawsuit pay?

The specific amount of the American-Amicable lawsuit payout varies depending on the case. Details on settlements or payouts from lawsuits involving American-Amicable would be found in legal records or official company statements.

Who is the largest life insurance company in the US?

The largest life insurance company in the US by assets and market share is typically MetLife, although rankings can vary depending on different metrics.

Does American-Amicable have living benefits?

Yes, American-Amicable offers living benefits in some of its life insurance policies, allowing policyholders to access a portion of their death benefit while still alive under certain conditions.

Does it matter what company you get life insurance from?

Yes, it does matter which company you get life insurance from, as the quality of coverage, customer service, financial stability, and claims payment can vary significantly between companies.

What is AIG called now?

AIG is still officially known as American International Group, although it may operate under different brand names for various segments of its business.

How long has AIG insurance been around?

AIG insurance has been around since its founding in 1919, making it over a century old in the insurance industry.

How long does it take to get life insurance money from AIG?

The time it takes to get life insurance money from AIG can vary but typically ranges from a few weeks to a couple of months, depending on the complexity of the claim and the completeness of the documentation.

Is AIG financially stable?

As of the latest reports, AIG is considered financially stable, with strong credit ratings from major rating agencies. However, it’s always wise to review the most recent financial statements and ratings.

What is an average life insurance policy payout?

The average life insurance policy payout varies widely but typically ranges from $100,000 to $1,000,000, depending on the policy and coverage amount.

Does AIG have a good reputation?

AIG generally has a good reputation, though it faced challenges during the 2008 financial crisis. It is well-regarded for its financial strength and range of insurance products.

What is the rating of American life insurance?

The rating of American life insurance companies can vary by provider and rating agency. For specific ratings, one would need to check sources such as AM Best or Standard & Poor’s for the most current evaluations.

Which is the leading life insurance company?

The leading life insurance company can vary based on metrics like premiums, assets, and market share. Companies like MetLife, Prudential, and Northwestern Mutual are often considered leaders in the industry.

What happened to American Life Insurance Company?

The American Life Insurance Company was acquired by MetLife in a transaction that took place several years ago, integrating it into MetLife’s broader insurance operations.

What is the average life insurance premium in the US?

The average life insurance premium in the US can range from $300 to $1,000 per year, depending on factors such as age, health, coverage amount, and policy type.

American Amicable Life Insurance Review: What’s the bottom line?

There are many life insurance companies to choose from. American Amicable offers a multitude of plans with a user-friendly construct. With no-exam policies, they could be the right fit for you.

Now that you’ve read this review, don’t wait to save money on life insurance. Click on our FREE quote tool to get affordable life insurance rates. Get started now.