Life Insurance Incontestability Clause (Terms Explained)

The incontestability clause prevents insurers from denying a death benefit claim over simple errors or omissions on the original life insurance application. Term life insurance rates can be as low as $12.70/mo or $152.40/yr, and you can rest assured knowing that your payout is protected by the incontestability clause in your life insurance policy.

Read moreReady to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

UPDATED: Jun 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jun 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- An incontestability clause protects you from losing your life insurance policy due to loopholes in the original agreement.

- Every life insurance policy contains an incontestability clause in some form.

- Most states allow certain exceptions to the incontestability clause.

- Comparison shopping ensures that you find the best life insurance policy for your needs.

One thing you’ll learn in our life insurance learning center is that a life insurance policy, such as a permanent life insurance policy, is a legal contract between you and the insurer. Like any contract, there is some important fine print you need to understand.

The incontestability clause in a life insurance contract is one such item. Fortunately, its fine print meant to protect you, not trap you.

The incontestability clause in life insurance prevents insurers from digging through the original application to find an error that would nullify the contract after you’ve filed a claim.

We designed this guide to explain everything you need to know about the life insurance incontestability clause, as well as give an overview of the application process to make sure you don’t make any errors in the first place.

Knowing that the coverage you buy is protected due to the incontestability clause, you can start comparing affordable life insurance rates today by using our free quote tool above.

What is an incontestability clause?

Before we jump right into the incontestability clause life insurance definition, we need to answer a few vocabulary questions.

What does contestable mean in insurance?

Contestable means that an insurer is within its rights to investigate and deny a claim for a specific reason.

What does incontestable mean in insurance?

Incontestable means that an insurer doesn’t have the right to investigate and deny a claim for a specific reason.

Why is this important? According to the Insurance Information Institute, the life insurance industry pays out between $65 billion and $80 billion in life insurance claims every year. The following table shows the latest data on total death benefit payments.

Annual Life Insurance Death Benefits Paid (2014–2018)

| Year | Death Benefits Paid |

|---|---|

| 2014 | $65,960,933,000 |

| 2015 | $72,320,822,000 |

| 2016 | $73,996,171,000 |

| 2017 | $74,942,640,000 |

| 2018 | $77,430,727,000 |

Life insurance is a business. Despite all the positive impact life insurance coverage can have on families, the insurer’s priority is to make a profit. Without that profit, they wouldn’t have the money to honour their life insurance contracts in the first place.

In the earliest days of the industry, it wasn’t uncommon for some unscrupulous insurers to look for any reason they could to deny a life insurance claim to maximize their profit margins.

One common way they did so was by pouring through the original life insurance application, looking for errors on the part of the insured, and then claiming the contract was never valid because of them.

Even if the error was a simple, inconsequential mistake, they argued that the applicant misrepresented themselves, and therefore the company wasn’t obligated to pay.

What happens if you lie on your life insurance application? You will pay higher rates or be denied coverage outright.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How does an incontestability clause protect life insurance buyers?

The practice was so common in the earliest days of the industry that reputable insurers in the 1800s introduced the incontestability provision in life insurance as a way to show customers that they were trustworthy.

The clause states that a life insurance contract cannot be voided after a certain period due to a misstatement as long as the premiums are paid.

The incontestability clause was a marketing initiative long before it was a law. Since then, state governments have mandated that life insurance companies add the clause to every policy they issue.

Though the law can vary slightly from state to state, every policy contains the protection in some form.

The contestability period varies, but it’s typically two to three years. It’s up to the insurer to verify all of the insured’s information during that time. Once that period ends, the insured isn’t held responsible for any errors.

What are the exceptions to an incontestability clause?

Most states do allow certain exceptions to the incontestability clause. There are still certain situations in which they can deny or adjust your claim.

So, the incontestable clause allows an insurance company to contest a life insurance policy but under what circumstances?

Incontestability Clause: Age or Gender

Age and gender are two of the most important factors in determining your rates. Most states allow insurers to adjust premiums at any time during the life of the policy if it’s discovered that the applicant misstated either of the two, but they can’t cancel the coverage completely.

If the insurer discovers a mistake in age or gender while reviewing a claim, they can’t deny the death benefit, but they can deduct the additional premium owed from the total death benefit payout.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Incontestability Clause: Intentional Insurance Fraud

An insurance company can contest a life insurance contract due to application fraud within. So, if the insurer discovers that the applicant intentionally provided false information to obtain a lower rate or higher face value, most states will allow them to deny a claim. (For more information, read our “Life Insurance Face Value (Terms Explained)“).

If intentional insurance fraud is discovered during the insured’s lifetime, not only can the insurer cancel the coverage, but that person could also face criminal charges.

Read more: What is life insurance fraud?

Incontestability Clause: Policy Lapse

If a policy lapses due to missed payments, the contestability period could start over again once the coverage is reinstated.

So, even if someone was five years past their original insurance contestability period when the policy lapsed, they could have to wait another two years until they’re in the clear again.

What happens if you die during the contestability period?

If you die during the contestability period, the insurance company will investigate to make sure all of your information is correct, as they are still within their legal timeframe to do so.

As long as your information is correct, the life insurer is obligated to pay the death benefit.

A life insurance contract is valid once you make your first payment, even if you die only a few hours later.

If the insurer does find errors, they have two options depending on the severity of the mistake.

As long as the errors are minor, the insurer can calculate the additional premium you should have been paying based on the correct information and simply deduct that amount from the death benefit. If the error is significant, the insurer could deny the claim.

Also, if you die during the contestability period, the death benefit will likely be delayed because the insurance company will need more time to investigate the claim than they would outside of that period.

What are the basics of life insurance?

A life insurance policy is a contract between you and the insurer. In exchange for a regular fee, the insurance company promises to pay a guaranteed lump-sum payment to your beneficiary upon your death.

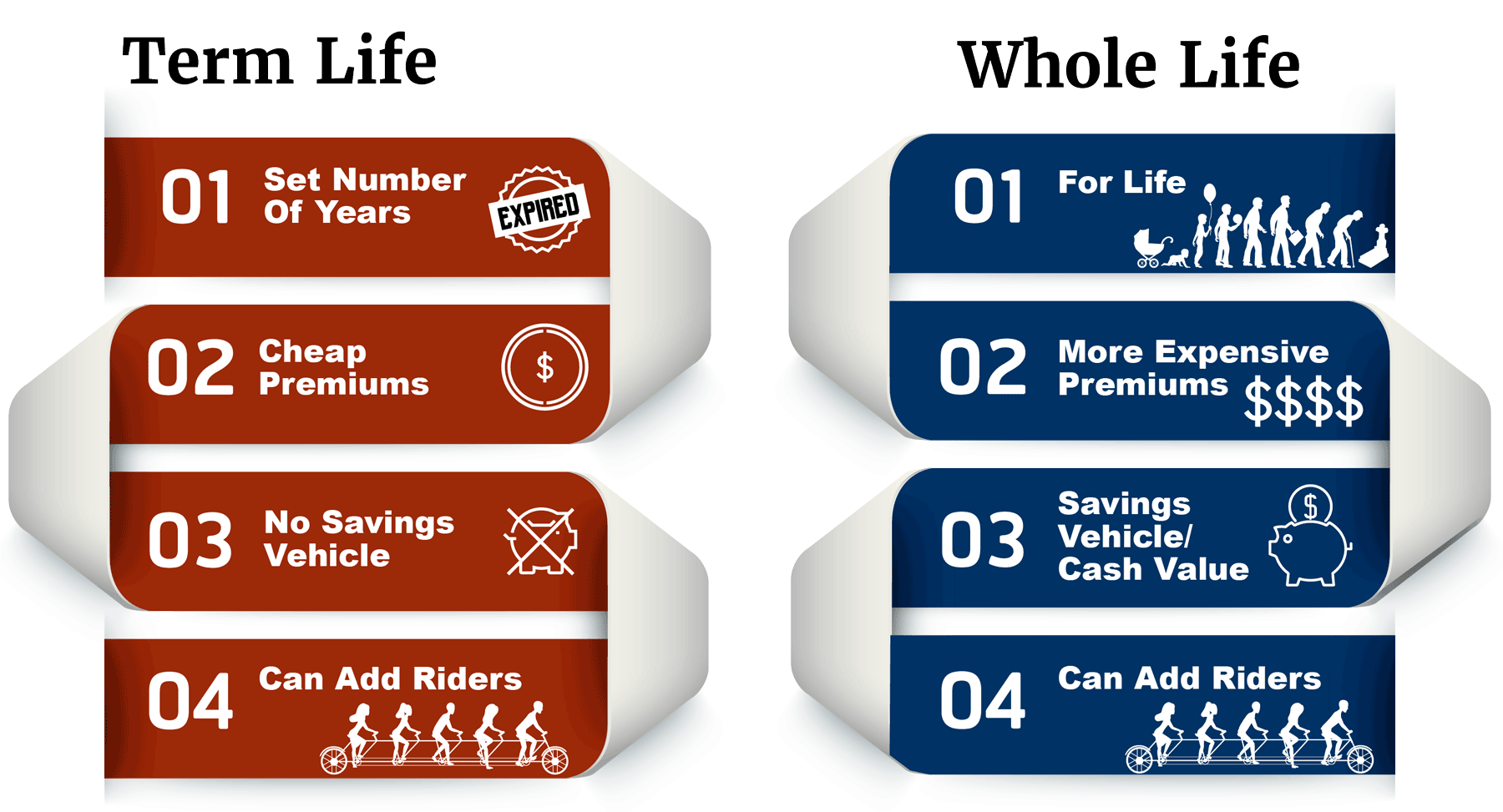

All life insurance policies fall into one of two general categories, term or whole.

Term life insurance provides temporary coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you renew for a new term.

Permanent life insurance (often called whole insurance) provides coverage for as long as you live.

For example, if a 25-year-old man buys a $500,000, 30-year term policy, that coverage ends at age 55. If he dies any time before 55, the insurer pays his beneficiary $500,000. If he dies any time after, the insurer doesn’t pay anything.

If that man purchased a $500,000 whole life insurance policy, the coverage would never end. As long as he remembered to pay his life insurance premiums on time before his death, the insurer would pay his beneficiary $500,000, regardless of his age.

Alternatively, a late payment on life insurance may result in reduced or no payout. Figuring out how to remember to pay our life insurance premium on time will save you money and will likely keep your policy active.

Whole insurance is naturally the more expensive of the two options. With a term policy, there’s always a chance the insurer won’t have to pay a benefit.

With a whole policy, they’re guaranteed to pay. Therefore, they charge higher rates to minimize their losses when that time comes.

Whole policies also come with a built-in savings component. A portion of your premiums is placed in an interest-bearing account that either grows according to a fixed rate set by the insurer or according to market factors similar to a retirement savings account.

The money earned from the savings account is either added to the death benefit or used to pay future premiums.

It’s important to weigh the benefits and costs when choosing between term or whole life insurance.

How does life insurance work?

The basic life insurance process consists of the following steps:

- The customer fills out a life insurance application and a medical questionnaire.

- The insurer sends the application to an underwriter.

- The underwriter reviews the application to determine the risk of insuring the customer.

- The underwriter may request the customer complete a full medical exam.

- The underwriter either approves or denies the applications.

- If approved, the underwriter assigns a risk classification, which determines the premium rate.

- The policy goes into effect and the customer begins making regular premium payments.

- If the premiums are current when the customer dies, the life insurer pays out the guaranteed face value of the policy.

Again, the insurer has two years from approval to find mistakes in the application and either cancel coverage or adjust premiums based on those findings.

What does life insurance cover?

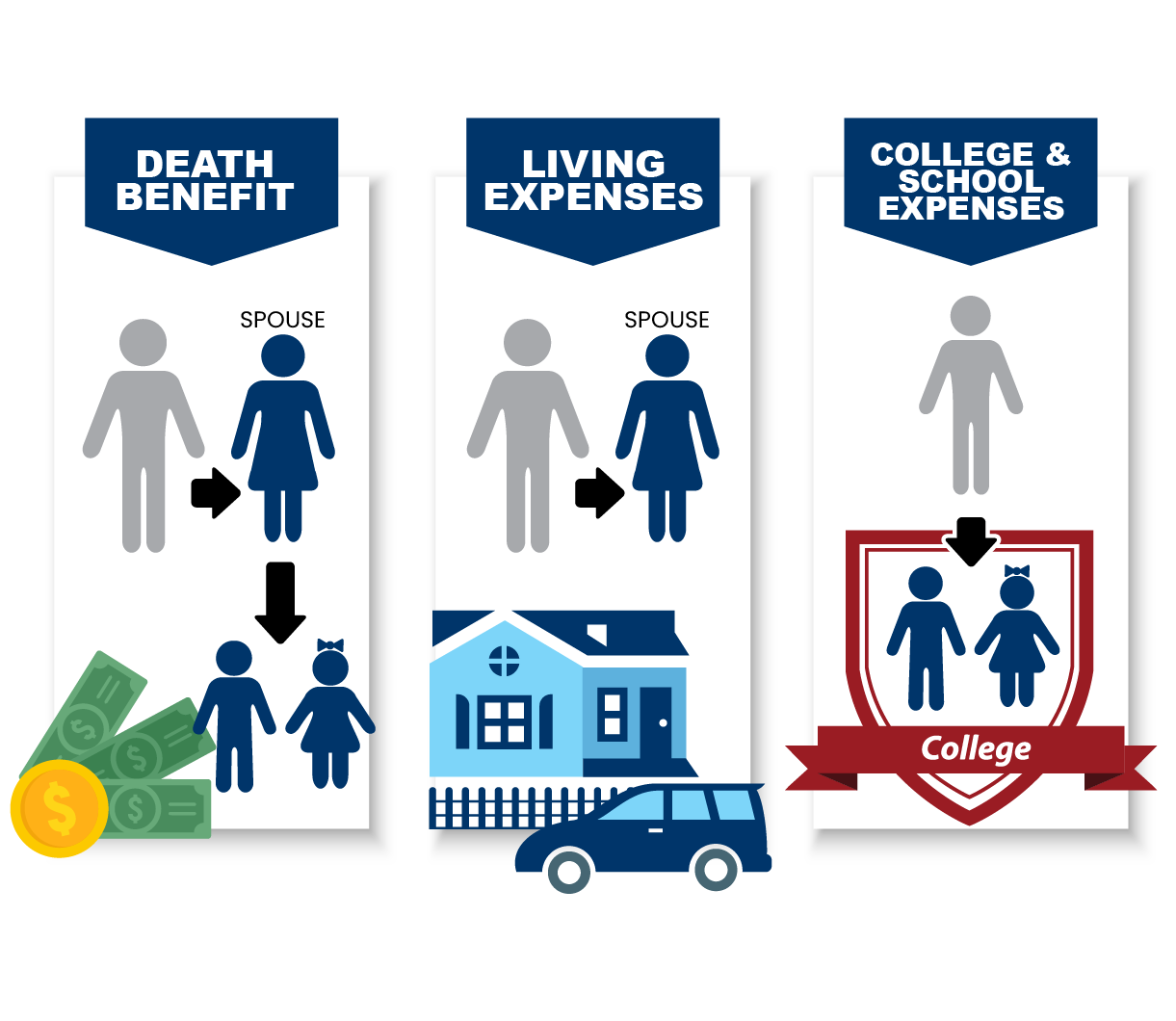

Life insurance is generally used to cover two types of obligations: immediate and future.

Immediate obligations are those expenses that need to be paid soon after your death. They include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are expenses (some planned, some not) that need to be paid in the years following your death. They might include:

- Income replacement

- Spouse’s retirement

- Children’s college tuition

- Emergency savings fund

It’s important to choose a coverage amount that satisfies all obligations if you want life insurance to protect your family from a blowout of debt after your death.

What factors affect your life insurance rates & approval?

There is no industry-standard price for life insurance. Rates vary for everyone. Your premiums are determined by several factors, primarily the following.

- Age – Age is one of the most important factors in determining insurability. The older you are, the closer you are to death. The longer you wait to buy a policy, the higher your rate will be.

- Gender – Statistically, men have shorter life expectancies than women. Because of that, they typically pay lower premiums.

- Health history – Healthy people have longer life expectancies. Longer life expectancy translates to lower premiums. To determine your overall health, insurers may require a medical exam.

- Family medical history – Because many diseases are hereditary, most insurers will also inquire about the health of your family. For more info, read our article on how family history affects your term life insurance rates. Learn more about how family history and life insurance rates are connected.

- Occupation – Some jobs are more dangerous than others. If you have a job with a high risk of accidental death, you can expect higher premiums. For more info, read our list of jobs that could raise your life insurance premium.

- High-risk habits – Insurers will also inquire about high-risk habits such as flying, racing, mountain climbing, or any other regular activity with high injury risk.

- Tobacco use – The most common high-risk habit that insurers look for is tobacco use. Smokers pay higher rates than their non-smoking counterparts in every demographic.

These are all of the items that the insurer will research during the contestability period. A misstatement on any one of them could affect your coverage, so it’s important to be thorough and honest through every phase of the application and approval process.

Read more:

- Life Insurance vs. Accidental Death & Dismemberment (AD&D) Insurance: Which Is Better for You

- Does your job affect your life insurance?

How are life insurance payouts distributed?

The death benefit is the lump sum of money paid to the beneficiary when the insured dies.

Death benefit claims are typically processed within 30 days of filing, though that payment could be delayed if the claim is filed during the contestability period.

Life insurance benefits are non-taxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits are subject to estate taxes.

Read more:

How does the life insurance death benefit work?

The death benefit for a term policy is fairly straightforward. When you die, the insurer pays the beneficiary the total coverage amount for your policy. The death benefit for a whole policy is slightly more complicated. It has two separate components.

The first is the face value.

The face value is the guaranteed amount of coverage that you purchase. For example, on a $100,000 policy, your beneficiaries will be paid a minimum of $100,000.

The second component is the cash value. The cash value is the interest your premiums have earned through the policy’s built-in savings component.

Depending on the type of benefit you choose, any money in that cash account at your time of death could be paid to your beneficiaries along with the face value.

The amount of that cash value depends on both how well your investments have performed and whether or not you accessed any of those funds during your lifetime.

Most policies allow you to use your surplus cash value to pay your annual premiums. The more you’ve done that, the less there will be for your beneficiary upon your death.

Many policies also allow you to take out personal loans using your cash value as collateral. These loans operate similarly to home equity lines of credit. You must repay them with interest.

Any outstanding balance at the time of your death will be deducted from your cash account and your face value, which could significantly decrease your beneficiaries’ payout depending on the size of the loan and accumulated interest.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What are the types of life insurance death benefits?

With many whole life policies, you have the option of choosing one of two insurance benefit types: fixed or increasing.

Fixed

With a fixed death benefit, the policy premiums decrease over time as the cash value increases so that the payout is always equal to the initial face value.

For example, if the cash value on your $250,000 policy grows to $25,000, the premiums will level out, so you’re only paying for $225,000 of coverage.

Once you die, that $25,000 cash value is added to the decreased $225,000 face value so your beneficiary receives the guaranteed $250,000.

With this option, the better your investments perform, the less you pay out of pocket for your coverage later.

Increasing

With an increasing death benefit, the premiums and face value remain the same over time.

As the cash value increases, the overall death benefit increases.

Using the previous example, if the cash value on your $250,000 policy grows to $25,000, the premiums will remain the same, so you’re still paying for the full coverage amount.

Once you die, the $25,000 cash value is added to the face value, meaning your beneficiary now receives a $275,000 death benefit instead of the $250,000.

An increasing benefit costs more over time, but also comes with the potential for a higher payout.

How can I shop for life insurance quotes?

If you’re currently in the market for a life insurance policy, here are some tips to keep in mind while you shop for term life insurance quotes to ensure you get the best coverage at the best price.

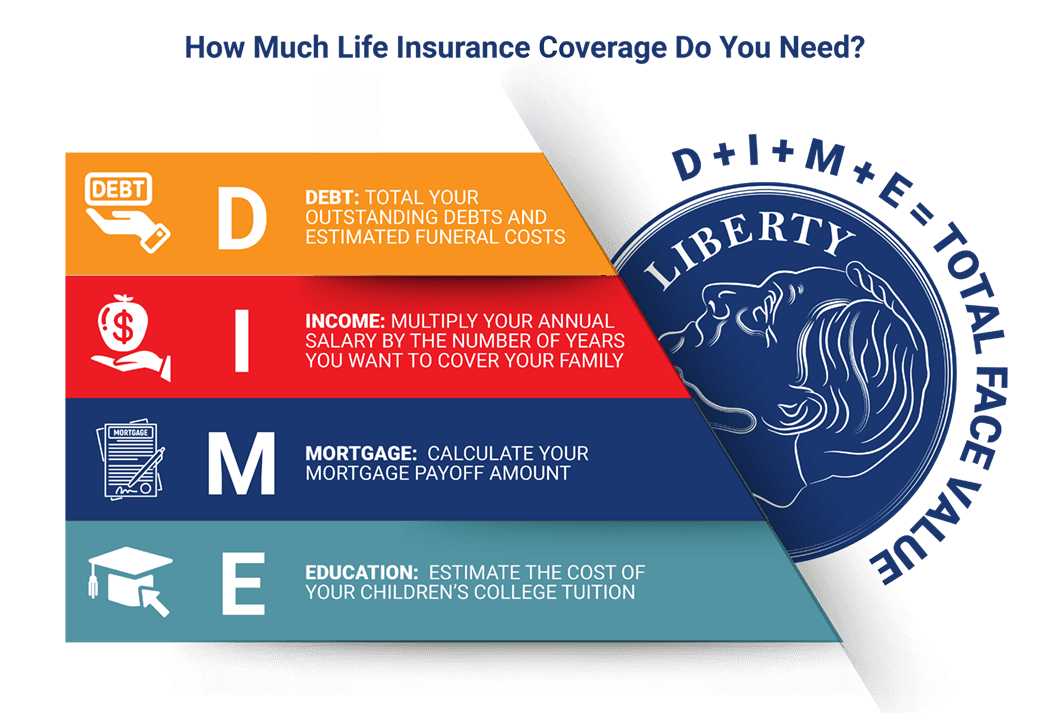

How much life insurance coverage do you need?

As discussed earlier, a life insurance policy needs to cover two types of obligations: immediate and future. The most common among those obligations are mortgage balances, income replacement for a spouse, tuition savings for a child, and credit debts. (For more information, read our “Is Tuition Insurance Worth It?“).

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need, but there are simple formulas you can use to give yourself a good estimate.

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym that stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you an idea of the minimum face value you’ll need.

Here is an example.

A husband who is a father of two is shopping for life insurance. He has an annual salary of $80,000. His wife also works full time. The family has a remaining mortgage balance of $100,000, $7,500 left on a car loan, and $5,000 in credit card debt.

They also plan to save $30,000 for each child to cover the average cost of four years of in-state tuition at a public university.

He plans to leave five years’ worth of his income for miscellaneous expenses and any unexpected future obligations. Once the mortgage is paid, his wife will have less need for his income and can live comfortably on hers alone.

After factoring in an average funeral cost of around $7,500 (according to the National Funeral Directors Association), the man’s insurance needs are as follows:

- Debt – $7,500 call loan + $5,000 credit card + $7,500 funeral costs = $20,000

- Income – $400,000

- Mortgage – $100,000

- Education – $60,000

- Total need – $580,000

To meet all of those obligations, he would need a life insurance policy with a face value of around $600,000.

In addition to calculating a face value, you also need to determine an appropriate term length.

If you purchase a whole policy, you don’t need to decide on a term length since you have lifelong coverage. However, if you choose a term policy, you need to choose a term long enough to cover all of your obligations.

For example, if you have 20 years left on a 30-year mortgage, you should choose a 20-year life insurance policy. If it will take you 30 years to reach all of your retirement savings goals, you should choose a 30-year term.

Here’s a list of things to consider when determining a term length:

- Number of years your spouse will depend on your income (years to retirement)

- Number of years dependent children will be living with you

- Number of years until co-signed or shared debts (like a mortgage) are paid in full

- Number of years until your assets or savings grow enough to cover your future obligations

You should choose a term that extends until your furthest milestones are reached. After you clear those hurdles, you’ll have much less need for insurance coverage.

What are the top life insurance companies by market share?

There are nearly 1,000 life insurance companies in the United States. Each of them has multiple policy types, different customization options, and varying prices.

Despite those differences, the policies from every insurer come with an incontestability clause, by law.

If you’re buying from a reputable company, you shouldn’t have to worry about that protection ever coming into play. The difficulty lies in sifting through all of your choices to find one.

If you’re looking for a reputable company, one of the best things to do is to start with the top-ranking insurers and then work your way down.

The following table shows the current top-20 overall companies of life insurance (which includes both individual and employer-sponsored group policies).

Top 10 Life Insurance Companies by Market Share & Protective Life Market Share

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $10,877,337,000 | 6.7% |

| 2 | Northwestern Mutual | $10,550,806,000 | 6.5% |

| 3 | New York Life | $9,385,843,000 | 5.8% |

| 4 | Prudential | $9,170,883,000 | 5.6% |

| 5 | Lincoln National | $8,825,314,000 | 5.4% |

| 6 | MassMutual | $6,874,972,000 | 4.2% |

| 7 | Transamerica | $4,867,311,000 | 3.0% |

| 8 | John Hancock | $4,657,312,000 | 2.9% |

| 9 | State Farm | $4,636,147,000 | 2.9% |

| 10 | Securian | $4,426,864,000 | 2.7% |

| 20 | DAI-ICHI Life Holdings Inc Grp (Protective Life) | $2,450,639,110 | 1.41% |

Read more: Securian Retirement Plans

Now that you know the top companies, let’s see some sample rates.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How much do life insurance rates cost?

To give you an idea of how much life insurance coverage might cost you, here is a look at the sample premiums for a non-smoker from those top companies.

20-Year Term

Average Monthly 20-Year Term Life Insurance Rates by Age and Gender

| Policyholder Age | $100,000: Male Average Term Life Monthly Rates | $100,000: Female Average Term Life Monthly Rates | $250,000: Male Average Term Life Monthly Rates | $250,000: Female Average Term Life Monthly Rates | $500,000: Male Average Term Life Monthly Rates | $500,000: Female Average Term Life Monthly Rates |

|---|---|---|---|---|---|---|

| 25 | $14.53 | $12.70 | $23.27 | $18.72 | $34.79 | $27.39 |

| 30 | $14.96 | $13.22 | $24.59 | $20.44 | $37.39 | $29.59 |

| 35 | $17.57 | $15.40 | $26.09 | $22.19 | $40.04 | $32.19 |

| 40 | $21.40 | $18.62 | $33.72 | $28.49 | $54.79 | $45.69 |

| 45 | $26.54 | $22.97 | $45.47 | $37.42 | $79.19 | $66.14 |

| 50 | $36.02 | $29.32 | $69.59 | $54.59 | $126.14 | $96.99 |

| 55 | $50.98 | $38.11 | $105.72 | $78.97 | $203.14 | $143.99 |

| 60 | $84.91 | $60.20 | $183.79 | $131.17 | $355.39 | $248.84 |

| 65 | $144.51 | $97.44 | $323.42 | $220.99 | $625.09 | $432.84 |

Whole

Whole Life Insurance Monthly Rates by Age, Gender, & Coverage Amount

| Age & Gender | $100,000 Policy | $250,000 Policy | $500,000 Policy | $1,000,000 Policy |

|---|---|---|---|---|

| 25-Year-Old Male | $94 | $85 | $225 | $203 |

| 25-Year-Old Female | $108 | $97 | $260 | $234 |

| 35-Year-Old Male | $128 | $113 | $311 | $273 |

| 35-Year-Old Female | $154 | $132 | $376 | $321 |

| 45-Year-Old Male | $191 | $156 | $468 | $381 |

| 45-Year-Old Female | $235 | $192 | $578 | $470 |

| 55-Year-Old Male | $295 | $243 | $728 | $599 |

| 55-Year-Old Female | $399 | $312 | $989 | $770 |

| 65-Year-Old Male | $528 | $422 | $1,311 | $1,045 |

| 65-Year-Old Female | $712 | $568 | $1,525 | $1,215 |

In the past, should an insurer find a reason to contest a life insurance claim, rather than pay out the full death benefit, they’d have simply refunded all of the premiums paid to the deceased’s estate.

Case Studies: Illustrating the Incontestability Clause in Life Insurance Policies

Case Study 1: John’s Misrepresentation

John purchased a life insurance policy and filled out the application form. However, he mistakenly provided incorrect information about his health history, omitting a previous heart condition. After John’s passing, his beneficiaries filed a claim for the death benefit.

During the contestability period, the insurance company discovered the misrepresentation and contested the policy. The claim was denied, and John’s beneficiaries were not able to receive the death benefit.

Case Study 2: Sarah’s Accidental Omission

Sarah applied for a life insurance policy and honestly answered all the questions on the application. However, she accidentally omitted a minor surgery she had undergone five years ago. Unfortunately, Sarah passed away within the contestability period.

During the investigation, the insurance company discovered the omission.

Although it was an unintentional mistake, the insurer adjusted the death benefit to account for the additional premium Sarah would have paid if she had disclosed the surgery.

Case Study 3: Mark’s Intentional Fraud

Mark intentionally provided false information on his life insurance application to secure lower premiums. He concealed his smoking habit and exaggerated his income to obtain a higher coverage amount.

Unfortunately, Mark passed away within the contestability period, and the insurer launched an investigation.

The company uncovered Mark’s intentional misrepresentation and canceled the policy, refusing to pay the death benefit to his beneficiaries.

The Incontestability Clause: What’s the bottom line?

It’s important to be as honest as possible when filling out a life insurance application and medical questionnaire. At the same time, everyone knows that mistakes do happen.

Thanks to the incontestability clause, you can rest assured that your loved ones won’t be denied a death benefit because of a typo you made a decade earlier.

As long as you answer every question to the best of your ability, no life insurer can legally reject your claim after the contestability period ends.

This guide was designed to give you a comprehensive overview of the life insurance incontestability clause, as well as a brief look at the life insurance buying process so you understand the type of information reviewed during the contestability period.

We hope that, after reading it, you have all the information you need to get started shopping for a policy and know which items to pay the closest attention to when applying.

Did we leave any of your questions unanswered? If so, be sure to check out one of the many in-depth guides on this site for information on every aspect of the life insurance process.

If you’re ready to buy life insurance coverage that is protected by the incontestability clause, enter your ZIP code into our free online tool to start comparing life insurance rates from companies in your area.

Frequently Asked Questions

What is a life insurance incontestability clause?

A life insurance incontestability clause is a provision included in most life insurance policies that sets a specific timeframe during which an insurer cannot contest or challenge the policyholder’s claims or statements made in the application, except in cases of fraud.

How does the incontestability clause protect the policyholder?

The incontestability clause protects the policyholder by providing them with a certain period of time, typically two years from the policy’s issuance, during which the insurance company cannot void the policy or deny a claim based on any misrepresentation or omission made by the policyholder in the application.

Can an insurance company contest a life insurance policy after the incontestability period ends?

Yes, although the incontestability clause generally provides a period of protection for the policyholder, it does not mean the insurance company loses all rights to contest the policy afterward. However, once the incontestability period expires, the insurer’s ability to contest a policy significantly diminishes, and they usually need to prove fraud or intentional misrepresentation to challenge the policy.

What are some common reasons an insurance company might contest a policy during the incontestability period?

During the incontestability period, insurance companies may contest a policy if they discover that the policyholder made intentional misrepresentations or omissions regarding their health, lifestyle, or other relevant information on the application. Fraudulent claims, such as faking one’s death or providing false documentation, can also lead to contestation.

Are there any exceptions to the incontestability clause?

Yes, there are a few exceptions to the incontestability clause. These typically include cases where fraud or intentional misrepresentation can be proven, or when the policyholder fails to pay the premiums. Additionally, if the policy includes a provision stating that certain conditions, such as suicide, are excluded during a specific waiting period, the insurer may contest claims related to those conditions within that period.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.