North Carolina Life Insurance [2026]

North Carolina life insurance offers residents a 10-day free look period, a 30-day grace period, and a guarantee of death payments up to $300,000. Life insurance varies from state to state, so expect your North Carolina life insurance rates to vary as well.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 23, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 23, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

We offer North Carolina residents life insurance from several of the best NC life insurance companies. Life insurance is very similar from state to state, with a few exceptions, so expect your North Carolina life insurance rates to vary.

However, this guide should help you understand the differences in North Carolina life insurance as well as find resources in your state. We’ll also show you how to get the best life insurance in North Carolina.

North Carolina Life Insurance Quotes

We offer North Carolina residents life insurance from several A-rated life insurance companies. Life insurance is very similar from state to state, with a few exceptions. This guide should help you understand the differences as well as find resources in your state.

Policy Cost – The premium (cost) you pay for your life insurance policy does not vary by state. It is the same regardless of which state you live in. Premiums are set by life insurance companies then approved by the State Insurance Department.

Company Availability – Not all companies are available in every state. For example, if a North Carolina life insurance company has not filed its product or rates with your State Insurance Department, that company won’t be available in your state. Company availability changes often due to new filings.

Product Availability – There are instances where life insurance companies offer only specific products or riders in a state. For example, a company may offer a child insurance rider on their policy, but the feature may not be available in all states. These exclusions can be viewed by clicking on the life insurance companies in the list below.

North Carolina life insurance also offers residents a 10-day free look period, 30-day grace period, and a guarantee of death payments up to $300,000.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Life Insurance Rates in North Carolina

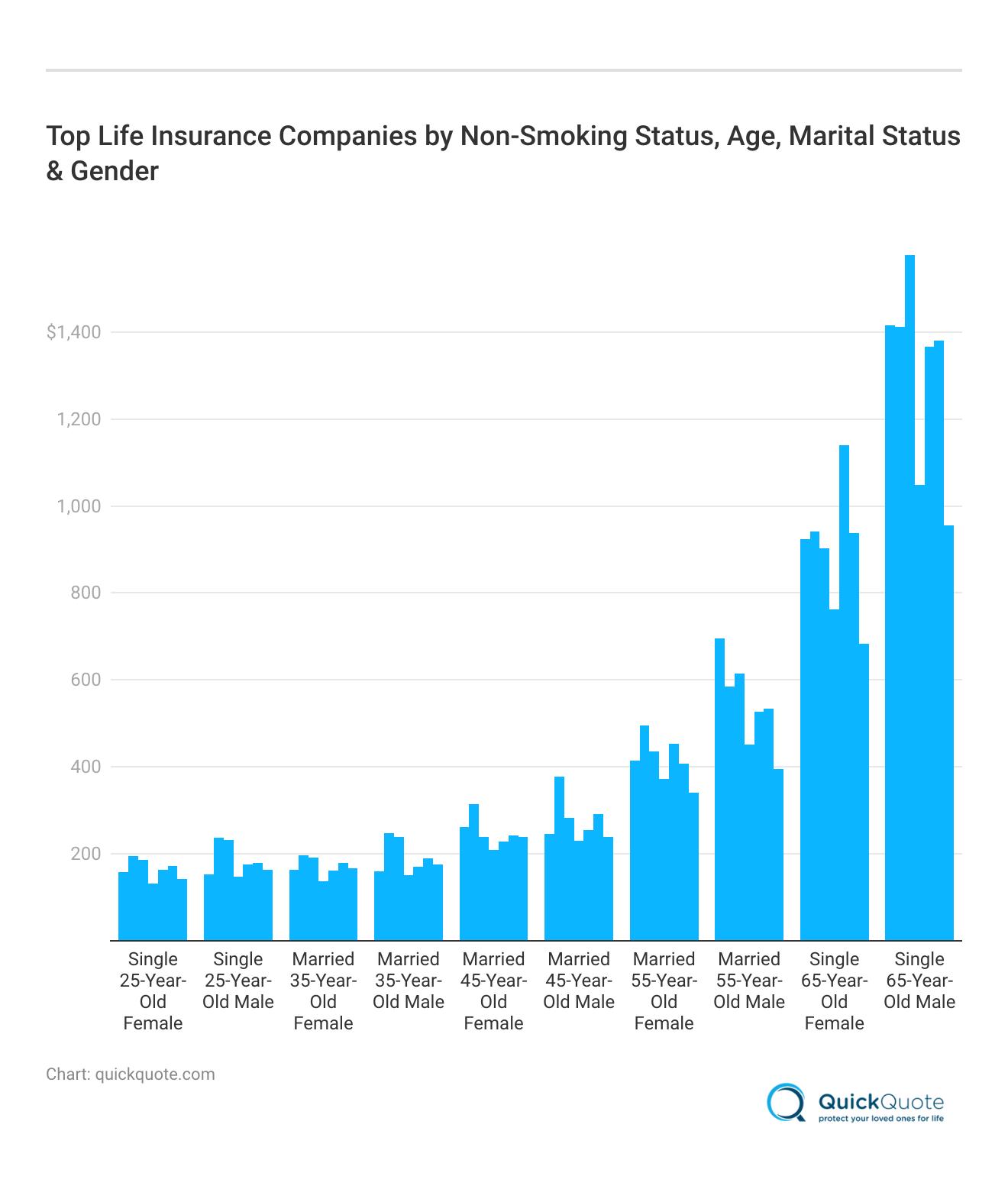

You may be wondering what to expect with North Carolina life insurance rates. In the chart below, you’ll find what the best life insurance companies in North Carolina charge based on age, marital status, and gender for non-smokers. However, it’s possible that your rates will be different, especially if you smoke.

You can also see how many life insurance companies there are in North Carolina versus the other southern states.

According to the chart, there are 10 North Carolina life insurance companies that specifically do business within the state. So, chances are, those 10 companies will offer the best life insurance in North Carolina. That also means more North Carolina life insurance policy options for you.

North Carolina Guaranty Association

State guaranty associations are committed to protecting resident policyholders and beneficiaries in the event of an insurance company insolvency. The association is made up of all insurance companies licensed to sell life insurance, health insurance and annuities in the state. If an insurance company becomes insolvent (goes out of business), the association steps in to protect policyholders by continuing coverage and paying claims, up to defined limits. (For more information, read our “How to Sell Your Life Insurance Policy“).

In North Carolina, a life insurance policy is protected up to $300,000. This amount is the maximum benefit provided for any one life. In other words, multiple policies on any one person are limited to this amount.

North Carolina Life Insurance Contacts

Here is a list of all the necessary state contacts for residents with North Carolina life insurance claims and other related matters.

Guaranty Association

If you need information about a North Carolina life insurance or health insurance guaranty, contact the North Carolina Life & Health Insurance Guaranty Association at 1-919-833-6838 or visit the website.

Insurance Department

For the latest updates from the North Carolina Department of Insurance, you can call 1-800-546-5664 or visit the website. Here, you can access resources like the NC Department of Insurance consumer services as well as find answers to questions like “how do I file a complaint against an insurance company in NC”?

If you want to know “how do I contact the NC Insurance Commissioner,” you can contact the NC Insurance Commissioner at the Insurance Commissioner Office in Raleigh, NC.

You can also obtain up-to-date information about NC state employee life insurance, access the North Carolina Department of Insurance agent lookup, and find a North Carolina insurance license record here.

Legal Info

QuickQuote is licensed to sell life insurance in North Carolina under Agency License Number 1000010137.

The licensed company principal is Tim Bain, Agent License Number 002890464.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

North Carolina Life Insurance Companies

American General Life Insurance Company

Fidelity Life Association

Haven Life / MassMutual

John Hancock Life Insurance Company

Lincoln National Life Insurance Company

Metlife Life Insurance Company

North American Company for Life & Health Insurance

Pacific Life & Annuity Company

Principal Life Insurance Company

Protective Life Insurance Company

Pruco Life Insurance Company (Prudential)

Sagicor Life Insurance Company

The Savings Bank Life Insurance Company of Massachusetts (SBLI)

Transamerica Life Insurance Company

United of Omaha Life Insurance Company

Frequently Asked Questions

What is life insurance?

Life insurance is a contract between an individual (the policyholder) and an insurance company, where the insurer agrees to pay a specified amount of money, known as the death benefit, to the policyholder’s designated beneficiaries upon their death. It provides financial protection and support to the policyholder’s loved ones in the event of their passing.

Do I need life insurance in North Carolina?

Life insurance is not legally required in North Carolina, but it can be a valuable financial tool to ensure your loved ones are financially protected after your passing. If you have dependents, outstanding debts, or a mortgage, life insurance can help replace lost income and cover expenses.

How do I determine the right amount of life insurance coverage?

The appropriate amount of life insurance coverage depends on factors such as your income, debts, future financial obligations, and the needs of your beneficiaries. Consider your family’s living expenses, mortgage or rent payments, outstanding debts, education costs, and any other financial responsibilities you want to cover.

Can I purchase life insurance if I have pre-existing health conditions?

Yes, it is possible to purchase life insurance if you have pre-existing health conditions in North Carolina. However, the availability and cost of coverage may vary depending on the severity of the condition. It’s recommended to consult with insurance providers or an independent insurance agent who can guide you through the process.

Can I change my life insurance policy in North Carolina?

Yes, you can change your life insurance policy in North Carolina. However, the options for making changes may vary depending on the type of policy you have. For example, term life insurance policies typically cannot be modified, while permanent policies like whole life or universal life may offer options for adjusting coverage or premiums. Contact your insurance provider or agent to discuss the specific options available to you.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.